Australia’s video market is on track to reach $12.3 billion in revenue by 2030, according to Media Partners Asia (MPA), underscoring the sustained shift from linear TV to streaming. While growth is moderating, with a 2.8% CAGR forecast from 2025, digital continues to dominate, led by global giants like YouTube and Netflix, alongside a competitive set of local incumbents.

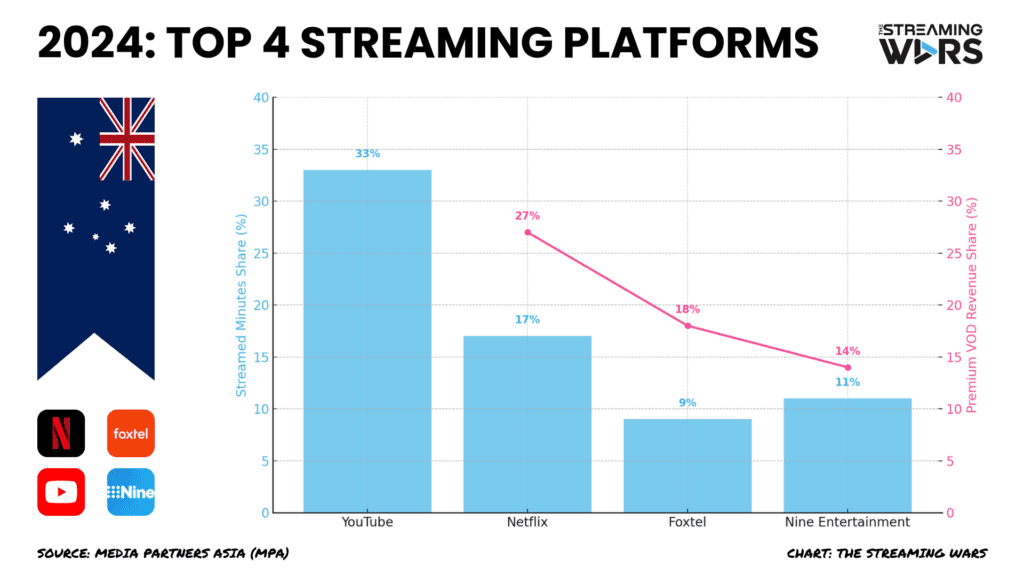

In 2024, YouTube accounted for 33% of all streamed minutes across mobile and connected TV, positioning itself as the top revenue generator. Netflix trailed fourth in total screen revenues, though it remains dominant in SVOD with a 27% share of the premium VOD market. Domestic players like Foxtel (18%) and Nine Entertainment (14%) round out the core competitive landscape, thanks to a mix of sports, local content, and dual revenue models.

Fragmentation and Monetization Take Center Stage

Australia’s streaming ecosystem is maturing fast. Between 2019 and 2024, online video’s market share jumped from 32% to 62%. Now, the fight is less about subscriber growth and more about monetization, and that’s pushing hybrid business models to the forefront. Platforms increasingly lean on ad-supported tiers to drive ARPU and retain price-sensitive viewers. With 82% of households connected via smart TVs, there’s fertile ground for scalable advertising products.

Netflix, Foxtel, and Prime Video are already operating ad-supported plans. Meanwhile, traditional broadcasters like Nine and Paramount’s Ten Network are using their BVOD (broadcaster VOD) platforms to offset declines in linear ad revenue — a transition that’s also gaining steam across the Tasman in New Zealand.

In short, the land down under is quickly becoming the land of bundled-up ad tiers, where monetization strategies are evolving as fast as viewing habits.

Sports and Strategic Alliances Become Differentiators

Sports have become a defining feature of Australia’s streaming experience. Kayo, Paramount+, Stan, and Prime Video now offer live coverage of significant leagues, turning premium sports into a must-have component for retention and monetization. If Disney+ pulls ESPN rights from Foxtel, it could dramatically shift the sports rights landscape — and the company’s position in the market.

At the same time, bundling strategies are gaining traction. Foxtel’s Hubbl product consolidates 18 SVOD and BVOD services into one interface, aiming to simplify the viewing experience. Amazon has rolled out similar features in New Zealand, with Prime Video offering add-ons for up to 14 other services.

In such a crowded ecosystem, platforms need more than just a shrimp on the barbie to stand out. Bundling is now as much about differentiation as it is about convenience.

The Local Content Equation Is Shifting

Despite the push for local storytelling, regulatory uncertainty is dampening investment. Australia’s decision to indefinitely delay a proposed local content requirement has taken pressure off global streamers, who are already tightening content budgets to improve margins. Similar attempts to introduce local content funding via taxation in New Zealand have stalled.

As a result, local production could be heading for a bit of a walkabout. With no regulatory tailwinds and an industry-wide focus on profitability, platforms are more likely to redirect resources toward scalable, ad-driven content and sports programming, both of which are proving to be safer commercial bets.

The Take

Ad tiers are no longer optional in Australia’s maturing video market — they’re a baseline expectation. With subscription growth flattening, platforms are now competing on ARPU, and ad-supported plans offer a clear path forward, especially in a cost-conscious consumer environment.

Sports have moved from a differentiator to a core offering. Services like Kayo, Stan, and Prime Video are leveraging live sports to anchor their value propositions, while platforms like Disney+ may soon shake up rights distribution if ESPN pulls back from Foxtel. The monetization potential here, particularly in advertising — is too big to ignore.

Aggregation is becoming a strategic necessity. As content fragmentation accelerates, bundling efforts like Foxtel’s Hubbl and Amazon’s Prime Video add-ons are helping consumers manage subscription fatigue while boosting engagement across platforms.

Lastly, local content investment is at a crossroads. With Australia pausing regulation on local production mandates, platforms have more flexibility and risk weakening their cultural relevance. The balance between global scale and local resonance will be critical in defining competitive advantage over the next five years.