Despite swinging and missing with an Opening Day outage that left fans unable to stream games, MLB remains a confident hitter at the media rights negotiation plate. The league is considering a new MLB.TV distribution model to entice potential buyers for its vacated media rights, left behind by ESPN. Unless there is a dramatic turn of events, MLB’s 35-year partnership with ESPN will end after the 2025 season, as publicly announced by MLB and the league’s out-of-market streaming package could find a new home in 2026 and beyond.

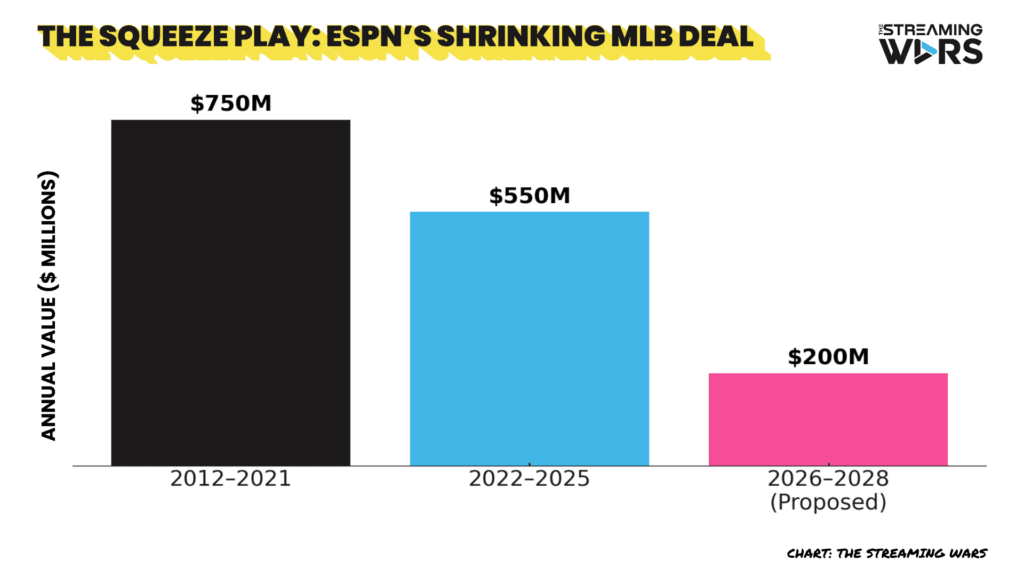

Since that public announcement, MLB Commissioner Rob Manfred and his team have been busy courting suitors to replace the $550 million annual media rights deal that ESPN is walking away from, a deal ESPN reportedly wanted to renegotiate down to no more than $200 million annually.

The current marketplace presents challenges for MLB to reach the $550 million annual benchmark, especially since potential buyers are also considering investments in media rights for UFC and Formula 1. ESPN recently declined to renew its Formula 1 media rights, for which they currently pay $90 million annually. Formula 1’s parent company, Liberty Media, is now seeking between $150 million and $180 million per year in its upcoming media rights deal.

ESPN’s exclusive negotiating rights with UFC end tomorrow. The current deal costs ESPN roughly $300 million per year, but the UFC is looking for $1 billion annually in its next contract. This new deal may involve multiple partners, possibly including ESPN.

However, MLB’s success won’t just be measured relative to the other properties in the market, but also its North American counterparts. MLB could still hit a home run and secure a lucrative deal for the 2026-2028 seasons if the right offer comes along.

MLB’s Next Deal Arrives at a Buyer Market Crossroads

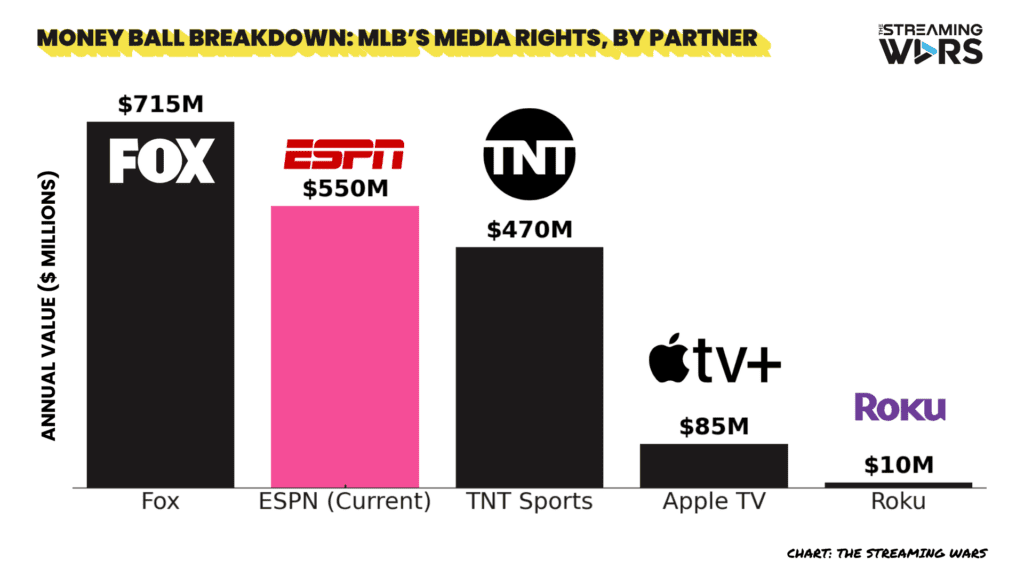

MLB’s current national media rights exceeds $1.8 billion across five partners.

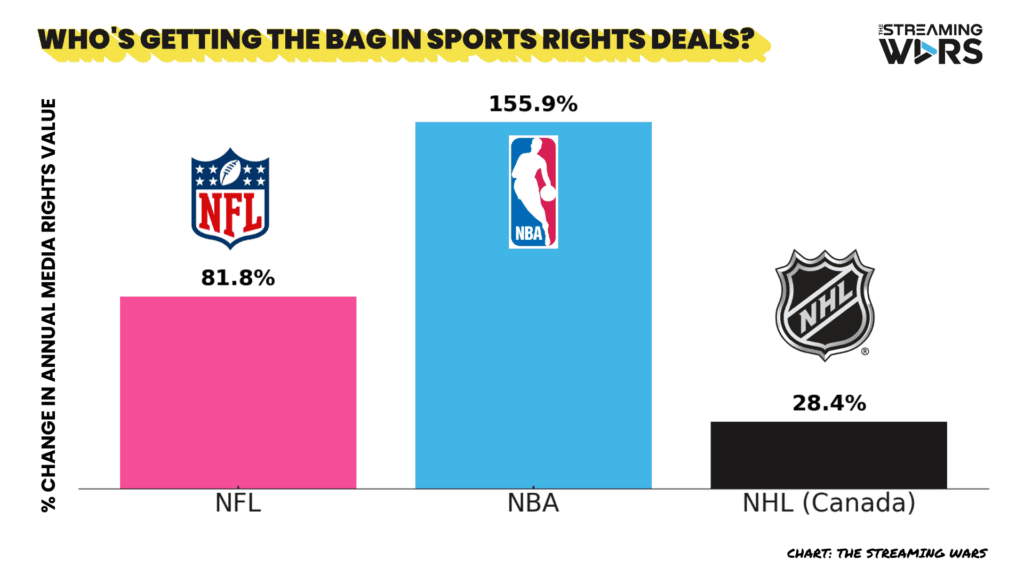

While MLB aims to recapture lost ESPN media revenue, other North American sports leagues are thriving with their national rights packages:

- The NFL’s current dominance in the North American sports market is underscored by its substantial 11-year, $110 billion media rights deal. This figure excludes revenue from out-of-market streaming and a three-year Christmas Day deal with Netflix. The league is expected to opt out of the current deal in 2029, likely influenced by a market reset established by the NBA.

- The NBA secured a significant 11-year, $76 billion media rights agreement with ESPN, NBCUniversal, and Amazon, commencing next season.

- The NHL recently agreed to a 12-year, $7.7 billion media rights deal in Canada with Rogers Communications.

While MLB will get its own bite at the apple in 2028 to reset its own market, its peers have seen material increases in their sports rights.

ESPN’s bridge package, which MLB must now monetize before its next round of media rights begins after the 2028 season, includes:

- Sunday Night Baseball – Weekly TV programming in an exclusive window.

- Home Run Derby – A key tenpole event during a summer window with minimal sports competition.

- American League and National League Wild Card Round – Peak event sports content.

The addition of MLB.TV, the league’s out-of-market streaming product, to the mix of media rights being negotiated is a significant development. Notably, MLB Extra Innings, the out-of-market product distributed by cable, satellite, and telco companies, was not mentioned in the Athletic’s report. This suggests that these products are likely locked into existing contracts through 2028, which decreases MLB.TV’s value.

MLB intentionally offers both MLB Extra Innings and MLB.TV to cater to fans of all ages and preferences: the former for older fans who may be resistant to change, and the latter for younger fans who prefer streaming services. This dual-track model reflects the current realities of MLB’s fanbase and operational limitations.

MLB’s Streaming Model Stands Alone — For Now

MLB’s centralized control of its out-of-market streaming package is unique in today’s streaming landscape. Surveying its North American counterparts, we see several distribution and ownership models:

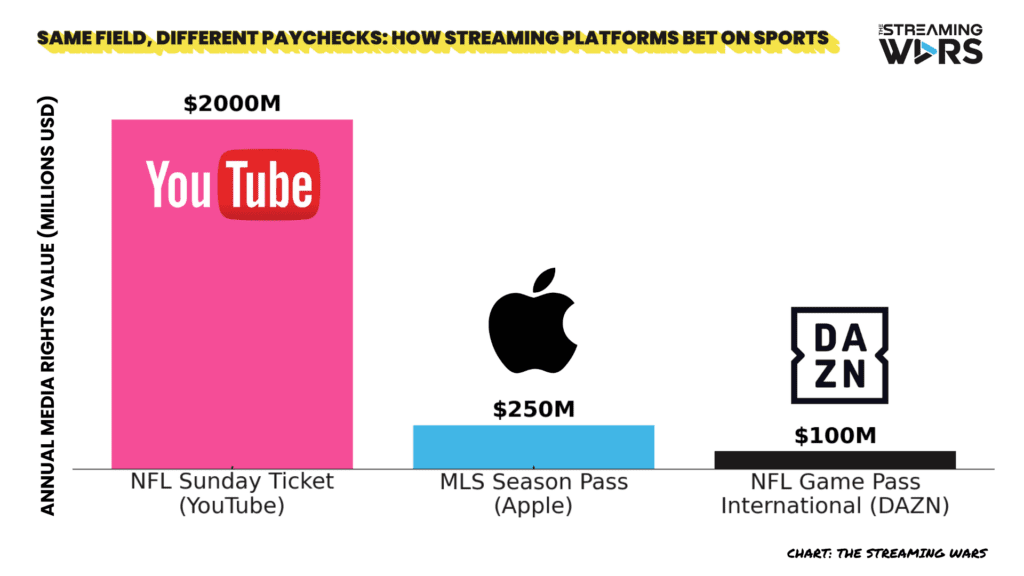

- NFL Sunday Ticket – Exclusively licensed and operated by YouTube via YouTube TV and YouTube Primetime Channels. YouTube has agreed to pay $14 billion over 7 years for the exclusive U.S. rights to NFL Sunday Ticket. In a separate deal, DAZN will pay the NFL $1 billion over ten years for the NFL Game Pass International rights.

- NBA League Pass – Managed and operated by NBA Digital, the joint venture between the NBA and TNT Sports and starting next season, moving to exclusive third-party distribution through Amazon Prime Video Channels

- NHL Power Play on ESPN+ – Distributed exclusively through ESPN+

- MLS Season Pass – Distributed primarily through Apple TV with new distribution through Comcast Xfinity and DirecTV. Apple has agreed to pay MLS $2.5 billion over 10 years for the rights to MLS.

MLB’s Media Portfolio — And Why It Matters

MLBAM, which includes MLB.com and its content, along with all data licensing rights for fantasy baseball and sports betting, is built on two primary assets, one of which is MLB.TV.

MLB Network and MLB Local Media are separate from MLBAM. The 24/7 national network, MLB Network, offers weekly live games and a variety of shoulder programming, which arguably contributed to the decline of ESPN’s Baseball Tonight. MLB Network is also available to fans direct-to-consumer, similar to the availability of NFL Network and NBA TV.

Due to MLB’s long-term goals of utilizing the infrastructure and distribution of MLB Network and MLB Local Media to solve the declining local media revenue for its clubs, it seems unlikely that they would relinquish control. However, to offset losses in media rights revenue, cut costs, and increase scale, they might consider offering an equity stake to a strategic partner.

This would be a different transaction than MLB’s sale of BAMTech to the Walt Disney Company, which began with a 33% investment in 2016, increased to 75% in 2017, and culminated in Disney assuming full control in 2022.

The Buyer Market Reality — Competing Priorities, Differing Appetite

Whether it’s just MLB.TV or a larger portfolio of media and technology assets, the inclusion of MLB’s direct-to-consumer service could invite several streamers and traditional media tables to the bargaining table.

- Amazon: Home to one of the most successful third-party distribution platforms through Amazon Prime Video Channels, existing distribution of local MLB content through partnerships with Main Street Sports Group’s FanDuel Sports Networks and the YES Network, overlapping audiences through distribution of NBA League Pass.

- YouTube: The exclusive home to NFL Sunday Ticket on YouTube TV and YouTube Primetime Channels. YouTube TV includes existing MLB broadcast partners TNT Sports and Fox Sports, as well as unique multiview options.

- Apple TV: Existing MLB digital partner and existing infrastructure built via MLS Season Pass package. Limited distribution relative to streaming peers.

- NBC/Peacock: Recently added NBC Sports RSNs as an add-on package, which could provide both broadcast reach for Sunday Night Baseball and more MLB coverage beyond owned and operated RSNs. However, Peacock notably ended the recent MLB relationship in 2023, which may limit NBC’s risk appetite.

- Fox: Existing MLB partner scheduled to launch a direct-to-consumer product before the 2026 MLB season and could be searching for complementary content.

- ESPN: Interested in long-term local rights and already offers NHL out-of-market package. In search of summer programming to mitigate future ESPN Flagship churn, but only at the right cost.

The NFL-Style Next Move — Selling Equity in MLB Advanced Media

MLB’s management of MLB.TV is similar to the NFL’s management of NFL+ and NFL Redzone, NFL assets that could be transferred through the sale of NFL Media. Based on the timing of the NFL Media sale and the valuation, that data point could push MLB to think beyond just packaging MLB.TV and think more broadly about its media assets, including MLB.com, MLB Network, and MLB.TV.

A strategic partner investing in MLB Advanced Media now could help MLB.TV reduce infrastructure vulnerability and gain entry into MLB’s media landscape before the next rights deal.

In addition to distribution rights for MLB.TV, a partner could obtain shared upside beyond content licensing. This partnership also allows MLB to continue exploring options to address the declining local revenue model and go to market with this strategic partner.

MLB is Monetizing Today’s Games, But It Must Build Tomorrow’s Platform

MLB has recently embraced innovation, making the game more exciting through the implementation of a pitch clock, larger bases, and the introduction of torpedo bats. Additionally, MLB is modernizing distribution, allowing fans to watch games on platforms like Apple Vision Pro or in shared reality at Cosm locations. This season, 26 of MLB’s 30 teams make their games available direct-to-consumer, through a variety of distribution models, while the league explores a national model without blackouts in 2028 and beyond.

As the game evolves to cater to future fans, there’s an opportunity to expand live game access beyond MLB.TV. Even Apple TV+ opted to distribute through Amazon Prime Video Channels, recognizing the benefits of increased access and viewership. This strategy also proved successful for Max, formerly HBO Max, which experienced growth after returning to Amazon Video Channels.

While bundling MLB.TV is a good initial step, but long-term value may necessitate MLB finding a strategic partner rather than simply securing a deal. Bundling MLB.TV is a smart first step, but true long-term value may only come if MLB is willing to fetch a partner, not just fetch a deal.

That’s the bet the NFL is making. And that’s the question MLB must answer.

My prediction: Major League Baseball strikes a deal with either YouTube or Amazon that sets the stage for a larger strategic partnership in 2028 and beyond.

It may not be a home run at first, but it could be a double or triple, setting the stage to round the bases and come home for the walk off victory a few years later.

Andrew Wamugi, an entertainment, sports, media, and technology professional, contributed to the content strategy of PlayStation 4 and Meta’s Spark AR platform during their early stages through partnerships with streaming media companies, including Netflix, Amazon Prime Video, Hulu and YouTube, and sports leagues like the NBA, MLB, NHL, NFL, and several European football clubs. You can read more of his insights and perspective in his newsletter, Fetch The Deal.