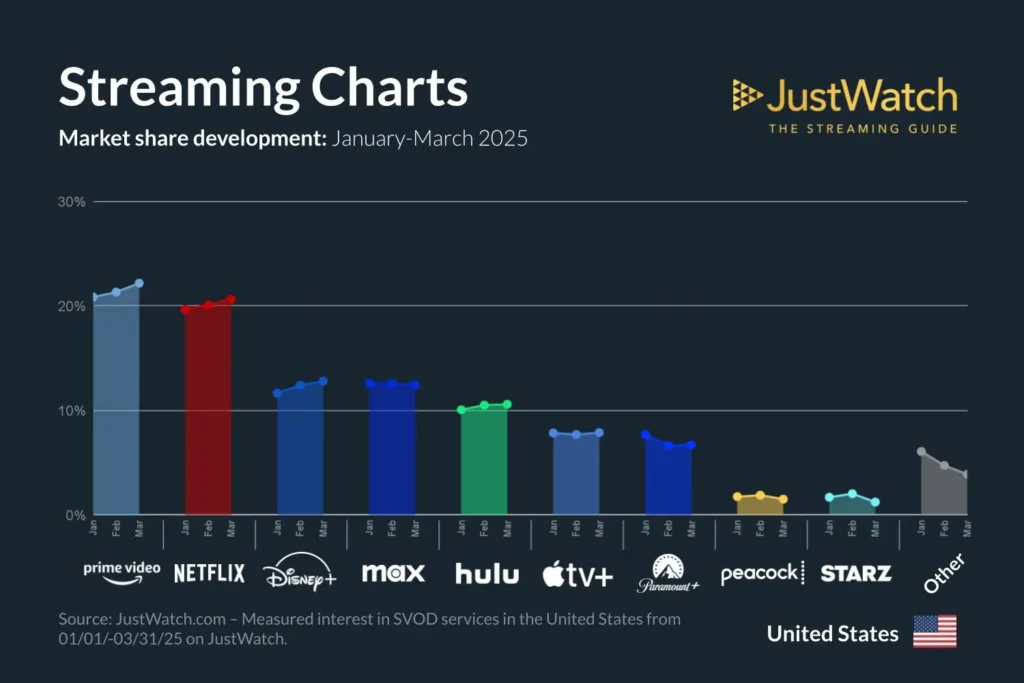

Apple saw a modest bump in its TV+ subscriptions with the season two premiere of Severance in January. According to new Q1 2025 data from JustWatch, the platform’s U.S. market share increased from 7% in Q4 2024 to 8%. It’s a gain, but not a breakthrough.

The broader streaming landscape remains primarily frozen in place. Prime Video (21%) and Netflix (20%) are still slugging it out at the top, while Max (13%), Disney+ (12%), and Hulu (10%) keep circling the middle. Paramount+ (7%) and Apple TV+ (8%) swapped spots in the “trying to stay relevant” tier. Meanwhile, the “Other” category shrank, hinting at further consolidation toward the majors. R.I.P. to your cousin’s favorite niche docuseries app.

Despite all the awards, the billion-dollar spend, and a brand reputation that screams luxury, Apple TV+ continues to trail in both share and scale. Estimated at around 45 million global subscribers, the service hasn’t disrupted the status quo—it’s joined it.

Prestige Without Power

Let’s be real: this isn’t some surprise twist. Apple’s entire streaming play has been prestige over everything—carefully curated originals, zero library bloat, and the kind of spend you only do when you have a trillion-dollar balance sheet. It’s a model that works… in theory.

And occasionally, it does. Ted Lasso, The Morning Show, Slow Horses, and now Severance have all delivered in demand and dollars. Parrot Analytics estimates Severance S1 alone generated over $200 million in revenue. Ted Lasso brought in a staggering $609.4 million from Q3 2020 to Q3 2024. That’s real money, even for Apple.

But for every spike, there’s a slide. Prestige content draws attention, but it doesn’t build stickiness without volume. Once you finish bingeing Severance, what’s next? Another eight-episode arc 12 months from now?

From OS to “Oh Well”

The real missed opportunity wasn’t in the content but in the platform.

The Apple TV app had a golden shot to be the streaming OS of the living room. It had UI elegance. It had device synergy. It had the early lead on aggregation. But Apple let that lead evaporate while chasing its HBO fantasy.

Then came the real sign of surrender: joining Amazon Prime Video Channels. Sure, it gives Apple TV+ access to Amazon’s massive user base. But symbolically? That’s a demotion. Apple went from trying to own the living room to becoming just another tenant in Bezos’ content mall.

It’s not just a distribution deal. It’s a public acknowledgment that Apple no longer wants to compete on platform terms—it wants to play nice inside someone else’s.

Premium Strategy, Boutique Results

Let’s not ignore the silver lining: Apple’s ARPU is strong. The 43% price hike in Q4 2023 led to churn, but also a 33% jump in UCAN revenue. That’s the kind of math Wall Street loves. But high ARPU only works when you can stop people from leaving. And when your library is 4,000% smaller than Netflix’s, the “why stick around?” problem only gets louder.

Genre variety? Still narrow. Licensing? Still nonexistent. Content cadence? Still slow. Apple may lead in visual fidelity, but you can’t HDR your way to engagement.

The Take

Apple TV+ isn’t losing. It’s just not winning. It’s prestige with no platform—content with no stickiness. A luxury brand still playing boutique while the rest of the industry turns into Costco.

Severance gave Apple a lift, but until the company decides whether it wants to be a streamer, an OS, or just a high-gloss accessory to Prime Video, it’s going to keep floating in this weird middle lane—admired, awarded, and ignored all at once.

It’s the long game, sure. But right now, that game’s being played on Amazon’s turf.