FAST services are no longer just digital reruns of old TV. A 42% surge in channels, skyrocketing sports and reality programming, and a looming battle over live content are pushing FAST into its next phase, where data, advertising, and differentiation will decide winners and losers.

While audience adoption continues to grow strongly, FAST’s real business impact lies in how services, advertisers, and content owners navigate discovery challenges, metadata gaps, and the increasing importance of exclusive content.

FAST’s rapid expansion raises critical questions: Can services differentiate when content is largely non-exclusive? Will metadata improvements unlock more ad revenue? How will the shift toward live sports change FAST’s economics? Gracenote’s latest research offers insights into these trends and reveals where FAST is headed.

FAST’s Growth is Real, but Differentiation is the Challenge

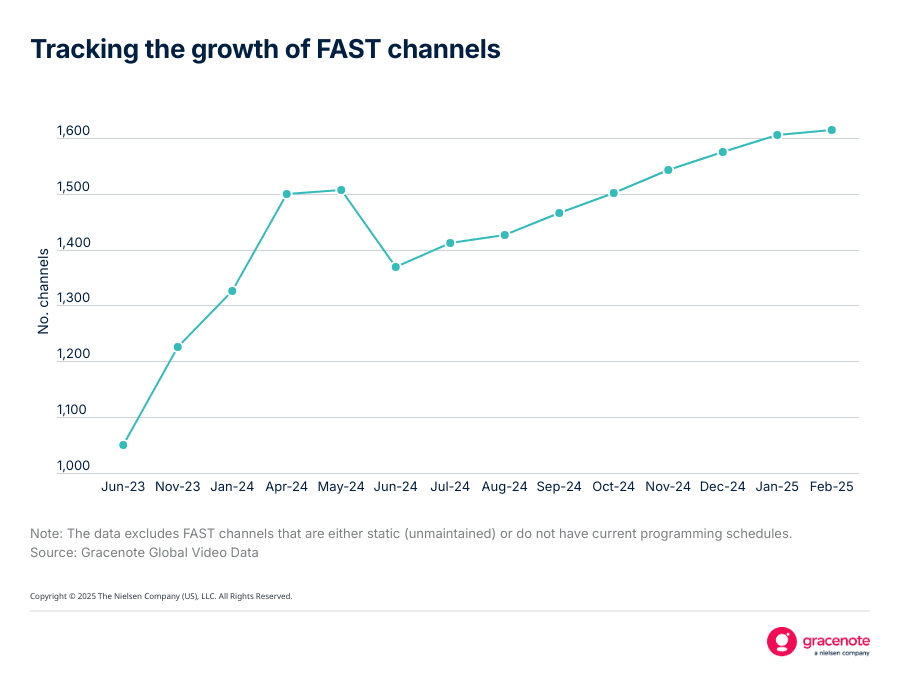

FAST is no longer just a dumping ground for library content. The number of available channels has grown 42% globally since mid-2023, with 1,610+ active FAST channels today, the majority (73%) in the U.S. Content libraries have expanded just as aggressively, with more than 178,000 individual programs and movies now available across FAST services.

However, channel proliferation raises a fundamental issue: differentiation. Unlike SVOD services, where exclusive content is a primary value driver, few FAST channels or programs are exclusive to a single service. Viewers can find the same channels on Pluto TV, Tubi, and The Roku Channel, reducing the incentive for service loyalty.

This distribution strategy has worked so far, helping scale FAST quickly. Still, as competition intensifies, services must find new ways to stand out—whether through enhanced user experiences, curated programming strategies, or investments in live content.

Metadata Gaps Are Costing FAST Services Money

One of FAST’s most significant obstacles isn’t just competition—it’s content discovery. As audiences navigate an overwhelming number of channels, missing metadata makes it harder to find relevant content.

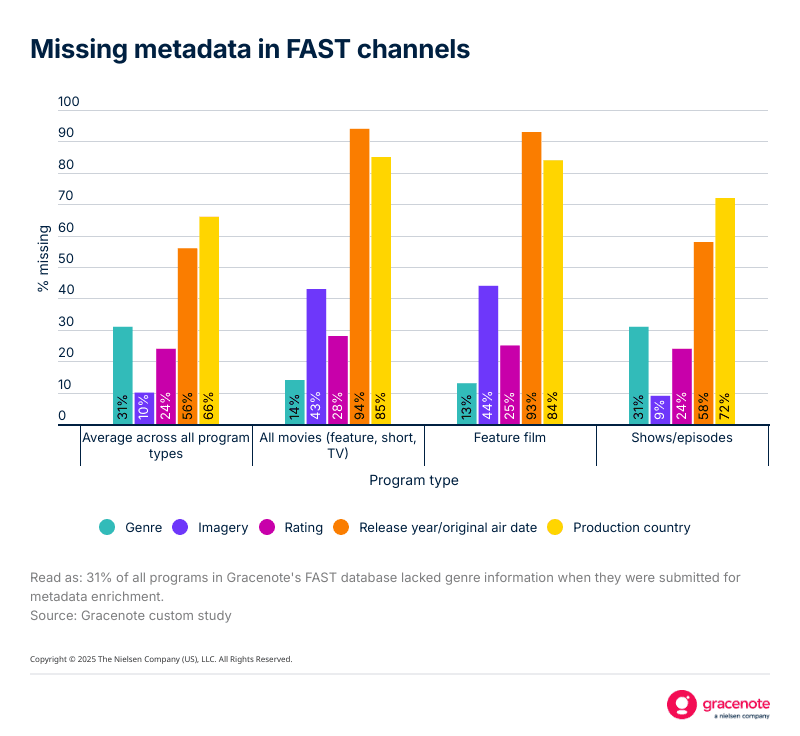

Key Metadata Issues in FAST:

- 31% of programs lack genre classification.

- 66% have no production country data.

- 24% have no rating information.

Why This Matters:

Frustrated Viewers = Higher Churn

- A mid-2024 TiVo study found that only 15.5% of U.S. viewers know what they want to watch when they start streaming.

- Nearly half (48%) find searching across multiple apps frustrating.

Poor Targeting = Lost Ad Revenue

- 70% of programmatic CTV ad inventory lacks genre metadata, making it harder for advertisers to place relevant ads.

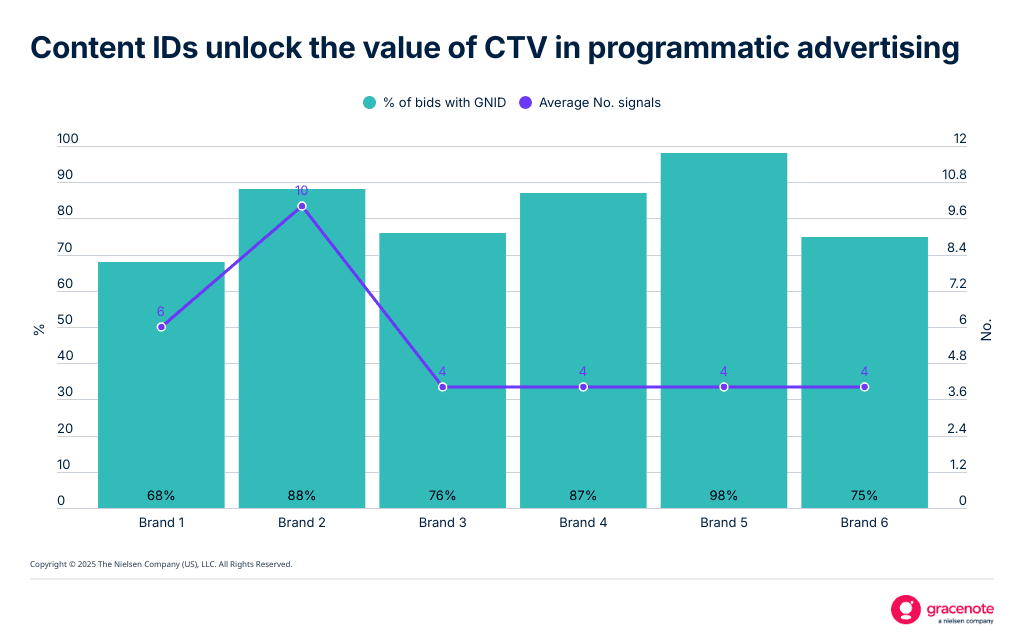

- When a Gracenote ID (GNID) is included, advertising opportunities increase by 712%.

Takeaway:

FAST services could unlock significant revenue simply by improving metadata quality—ensuring content is more discoverable and making ad placements more valuable.

Actionable Fix:

FAST services should standardize metadata, integrate AI-driven recommendations, and improve EPG layouts to enhance searchability and ad efficiency.

Live Sports: The Differentiator That FAST Needs?

FAST is no longer just about “lean-back” viewing of classic TV shows. Sports programming is now the second-largest genre, with 220 dedicated sports channels—up more than 105% since mid-2024. Even more striking is the rise of reality TV channels, which have increased by 626% over the same period.

The next evolution of FAST could be live sports. While FAST has traditionally been home to sports highlights and replays, services are now beginning to offer real-time games.

FAST’s Live Sports Expansion:

- Fox Corp. streamed Super Bowl LIX for free on Tubi, marking a first for a FAST service.

- Roku launched a premium sports FAST channel in August 2024, featuring live MLB and Formula 1 events.

- Vix Premium Deportes and FanDuel TV Extra broadcast live games in real time.

However, live sports will not follow the same broad distribution model as other FAST content. While viewers can find NFL, MLB, and PGA Tour highlight channels on multiple FAST services, live sports rights are expected to remain highly exclusive.

Why This Matters:

- Live sports could be the biggest shake-up FAST has seen. Unlike SVOD services, which lock live sports behind paywalls, FAST offers free marquee events.

- It positions FAST as a legitimate competitor to traditional TV, especially among younger, cost-conscious viewers.

- Could FAST’s live sports offerings accelerate cord-cutting the way ESPN once drove cable adoption?

If FAST services continue securing premium sports rights, they could reshape the economics of sports broadcasting and potentially disrupt traditional TV and premium streaming models.

The Future of FAST: Personalization, Not Just More Content

FAST’s continued growth is inevitable, but success will depend on how services refine the user experience. With thousands of channels, tens of thousands of programs, and increasing competition, services need to rethink how audiences interact with content.

Key strategies for FAST services moving forward:

- Leverage metadata and AI to improve content discovery. A better EPG (electronic program guide) or AI-driven recommendations could reduce user frustration.

- Experiment with exclusivity—whether in content, user experience, or live events. The most successful services will offer more than just access to the same programming.

- Maximize advertising efficiency by improving contextual ad targeting. With 75% of CTV ad spend happening programmatically, FAST services that optimize their metadata will see stronger ad revenues.

FAST is no longer just an alternative to pay TV—it’s one of the biggest forces reshaping the streaming economy.

Services that refine content discovery, secure exclusive content, and optimize ad targeting will emerge as long-term winners—the rest risk blending into the background of an increasingly crowded landscape.

Read the full Gracenote FAST Report here.