In the second quarter of 2025, Netflix significantly widened its lead over other streaming platforms regarding content growth. New data from Nielsen’s Gracenote unit shows that the five leading global subscription video-on-demand services, Netflix, Amazon Prime Video, Disney+, Apple TV+ and Paramount+, collectively added approximately 4,500 unique titles between February and May, marking a 5% increase in overall content volume compared to the previous quarter. Sports programming was the primary driver of this expansion, outpacing growth in both TV and film categories.

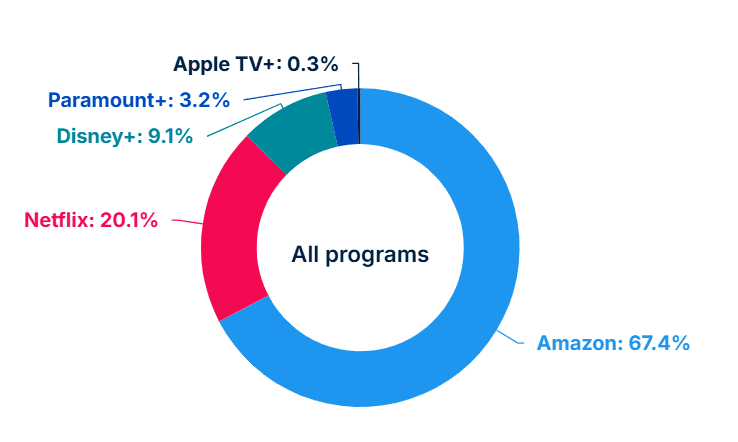

Netflix led all platforms with an 18.2% increase in its content catalog. Its share of total content across the five services rose to 20.1%, up from 17.9% in Q1. Apple TV+ posted the second-largest gain with a 3.7% increase, fueled by the seasonal return of Major League Baseball and Major League Soccer. Amazon Prime Video followed closely with a 3.2% increase. Disney+ and Paramount+ recorded more modest gains of 1.6% and 1%, respectively.

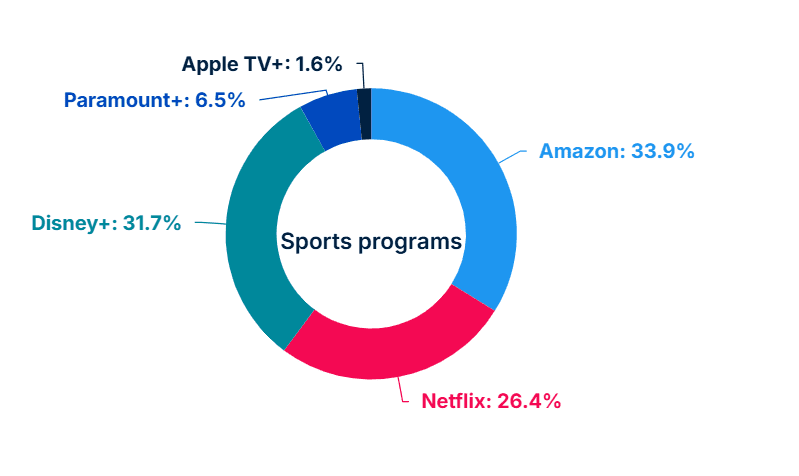

Sports content experienced the most substantial growth across the platforms. Combined, the five SVOD services expanded their sports libraries by 7.8%, compared to a 6.9% increase in TV programming and a 4% increase in movie titles. Netflix increased its sports content by more than 22%, reinforcing its commitment to live events and sports documentaries. Apple TV+ saw a 25% spike in sports programming, primarily from its MLB and MLS coverage. Amazon added 5% more sports titles, while Disney+ contributed incremental gains. Paramount+ was the only platform to scale back its sports catalog, with a 9% decrease in sports programming compared to the previous quarter.

Currently, Amazon Prime Video, Disney+ and Netflix account for 92% of all sports programming available across connected TV platforms. This includes live broadcasts, sports news, highlights and documentaries, solidifying their dominance in the sports streaming space.

The data suggests that Netflix is executing an aggressive strategy to scale its library faster than competitors, with sports content playing a critical role. Apple and Amazon are also leaning into sports to grow engagement and boost content volume. Disney+ and Paramount+ appear to be taking more conservative approaches to expansion.

Bill Michels, Chief Product Officer at Gracenote, emphasized the importance of discovery alongside volume. “Overall content volume continues to rise but the CTV apps making this content available continually shift,” Michels said. “Regardless of program type or any other attribute, effective content discovery helps streamers connect viewers to the entertainment they’ll enjoy most and get the most value out of each of the assets in their catalogs.”

The Q2 data highlights how competition among top SVOD platforms is intensifying, not just in overall content volume but in the types of programming prioritized. Netflix’s aggressive growth and dominance in both general and sports content suggest a clear effort to strengthen its market position. Meanwhile, Apple and Amazon are using seasonal sports to drive incremental gains. As audiences seek both depth and variety, sports is emerging as a critical battleground for streamers looking to sustain engagement and differentiate themselves in a saturated market.