As Wall Street increasingly pressures streaming companies to become profitable, services are being forced to find ways to retain control over their revenue streams and customer relationships. A growing frustration in the industry is the significant portion of revenue lost to platform taxes—fees imposed by all app platforms like Apple, Google, and Roku, which require streaming services to use their in-app billing systems. These platforms will then take a 15-30% cut of subscription revenue for facilitating transactions, a cost that can significantly impact profitability. Streaming companies are left to grapple with rising content and technology costs while platform fees eat into margins that are already razor-thin.

Platform taxes are not exclusive to subscription-based streaming services. Ad-supported models or services with ad-tiers also face similar challenges, as they are often required to share a significant portion—up to 30%—of their advertising revenue or inventory with platform operators. While this article primarily focuses on subscription video, the ad-supported side of the industry is experiencing parallel pressures and negotiations.

The Cost of Running a Direct-to-Consumer Streaming Service

Running a streaming service is more than just curating content. It requires massive investments in technology, infrastructure, and user acquisition to compete effectively. Here’s a breakdown of the core costs that companies face:

Content Costs

Maintaining a rich and exclusive content library is critical for streaming services, especially in today’s competitive market. Producing original series and maintaining a vast back catalog requires substantial up-front investment. This content library is the backbone of attracting and retaining subscribers, but it also means that companies need a massive user base to justify these costs. The stakes are even higher as companies aim to differentiate themselves with original programming, pushing costs into the billions annually for larger players.

Technology and Infrastructure Costs

Launching a streaming service requires heavy investment in technology. Companies must develop and maintain apps for multiple platforms—Roku, Fire TV, Apple TV, Android, iOS, Vizio, LG, and Samsung TVs. Beyond this, they need robust video infrastructure, including content delivery networks (CDNs) to handle high traffic, cloud storage for global content distribution, and scalable server infrastructure to ensure reliable performance. Recurring costs that didn’t exist in the traditional linear TV model.

“We’ve built a complete subscription system that handles everything from billing to retention. But because our app needs to be available on every TV and mobile platform, we’re forced to use each platform’s proprietary in-app billing solution. It’s completely redundant, and to make matters worse, these platforms require us to share a significant portion of our revenue. We’ve already invested heavily in building our own tech, yet we’re still being forced to duplicate efforts and lose revenue in the process.”

An executive from a leading streaming company recently told The Streaming Wars, “We’ve built a complete subscription system that handles everything from billing to retention. But because our app needs to be available on every TV and mobile platform, we’re forced to use each platform’s proprietary in-app billing solution. It’s completely redundant, and to make matters worse, these platforms require us to share a significant portion of our revenue. We’ve already invested heavily in building our own tech, yet we’re still being forced to duplicate efforts and lose revenue in the process.”

This frustration with redundancy and mandatory revenue-sharing is standard across the industry, especially among companies that have invested millions into building their infrastructure.

Platform Taxes: A Significant Burden

App stores like Apple’s App Store, Google Play, and Roku operate as gatekeepers, mandating the use of their in-app purchasing systems and collecting a significant share of each transaction. Streaming services must account for this “platform tax” when projecting revenue, complicating their financial models.

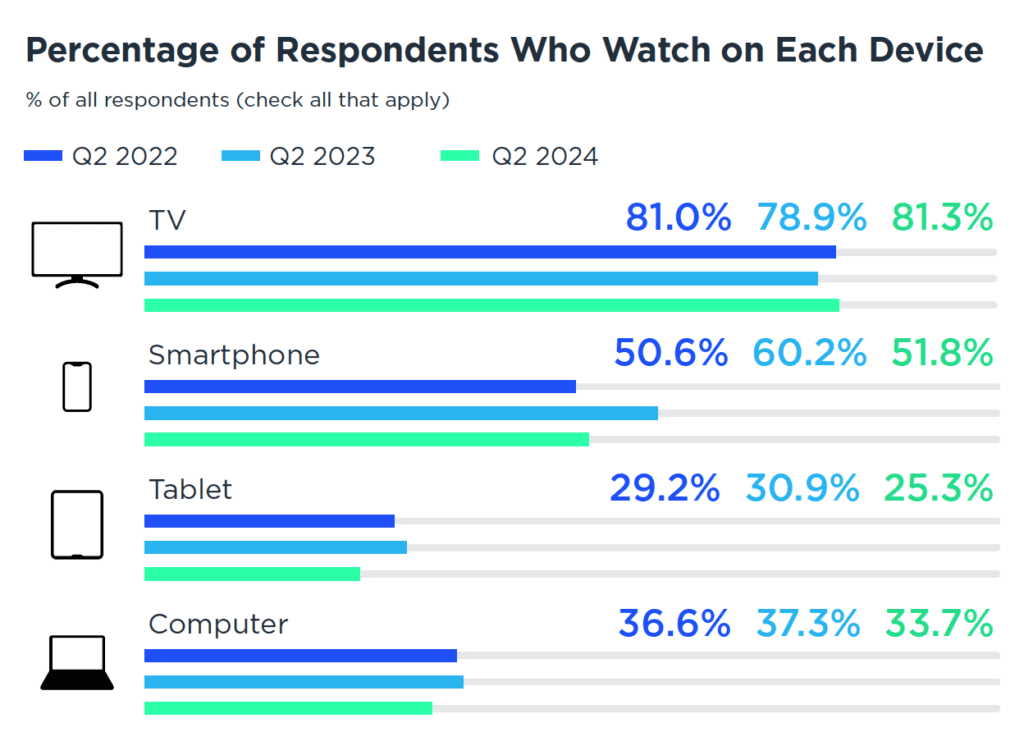

The reality is that video subscribers do not watch content on a single, dedicated platform; they consume content across various devices. According to the Q2 2024 TiVo Video Trends Report, the percentage of respondents who watch on each device is as follows:

- TV: 81.3% (It’s important to note that most households likely have a mix of TV operating systems so that this number could be distributed across multiple platforms)

- Smartphone: 51.8%

- Computer: 33.7%

- Tablet: 25.3%

The whole premise of streaming video is to allow viewers to watch content anywhere, anytime, and on any device, making it essential for streaming services to be available across these varied platforms.

As an executive at one of the operating systems bluntly stated, “Let’s say a customer signs up via their iPhone, which qualifies Apple to receive a 15% share of that customer’s subscription fee. But how is that fair to us if that customer spends 99% of their viewing time on our TV platform? This whole system is flawed, and streaming platforms are paying unnecessary fees to intermediaries without regard to where their service is actually used.”

Higher Operating Costs

In addition to content and platform taxes, streaming services also face higher operating costs. Managing a direct relationship with users means they must invest in customer service infrastructure, including call centers and technical support teams. In the old cable model, these responsibilities often fell to the distributors, but streaming services must now handle them in-house.

Marketing and User Acquisition

Streaming services must take a direct and comprehensive approach to user acquisition, often involving high marketing and promotion costs. Unlike the traditional model, where cable providers managed much of the marketing, streaming companies now must aggressively promote their services to acquire and retain subscribers. This includes substantial investment in digital ads, social media campaigns, and exclusive promotions to attract new users.

Beyond initial acquisition, streaming services also face ongoing costs for managing the entire customer lifecycle journey. This includes investments in customer relationship management (CRM) systems, personalized email marketing, customer support teams, and retention strategies such as loyalty programs, special offers, and user experience enhancements. These efforts are crucial for reducing churn and maintaining subscriber growth, but they add significant costs to the marketing budget.

Additionally, non-digital marketing efforts play an essential role. Streaming companies often invest in traditional advertising channels like TV commercials, billboards, event sponsorships, and print campaigns to build brand awareness and reach broader audiences. These strategies, while effective, require substantial financial resources and are a critical component of a well-rounded marketing approach.

The Complexity of DTC: Breaking Down Subscription Models

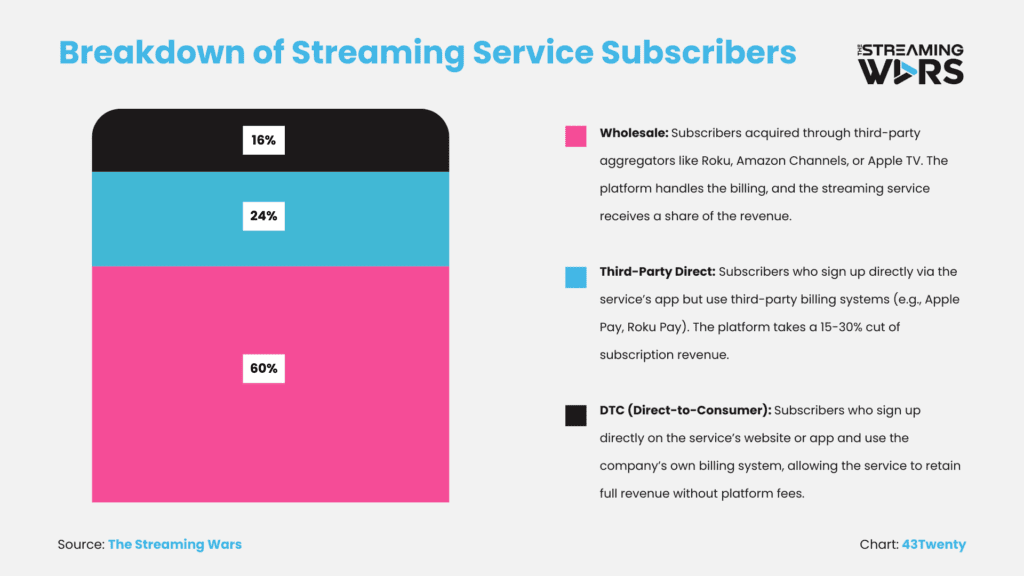

The term “direct-to-consumer” (DTC) is often used loosely in the streaming industry. At The Streaming Wars, we believe it’s crucial to break down streaming video subscriptions into three distinct categories: Wholesale, Third-Party Direct, and Pure DTC. This classification helps clarify what is actually direct-to-consumer and what is not.

In a recent article, “The Streaming Industry’s Kansas City Shuffle,” we discussed these categories to clarify how the industry should approach streaming subscriptions.

- Wholesale Subscribers

Customers get their streaming services bundled with other products through aggregators like Amazon Channels, MVPDs (Multichannel Video Programming Distributors), or mobile operators. In this model, the media company counts them as subscribers but doesn’t control key elements like billing, user experience, or customer data. The distributor manages those aspects. - Third-Party Direct Subscribers

These subscribers sign up through standalone apps (e.g., Acorn TV or Starz), but the transaction is handled via third-party payment systems like Apple Pay, Roku Pay, or Google Play. Even though it appears to be a direct subscription, the media company shares up to 30% of the revenue. It doesn’t have control over customer data, as transactions are processed through the third-party platform. - Pure Direct-to-Consumer Subscribers

Customers subscribe directly through a streaming service’s website or app. The media company controls all aspects of the relationship, including billing, user experience, and customer data. This is the ideal scenario for services aiming to maximize revenue and maintain complete control over their subscribers.

From our conversations with media executives, we’ve identified a typical breakdown of subscribers:

- 60% are Wholesale Subscribers – Most subscribers fall into this category, driven by bundling strategies with partners like Amazon Channels or mobile operators.

- 24% are Third-Party Direct Subscribers. While often mistaken for DTC, these subscribers still have revenue-sharing and data ownership issues with platforms like Apple or Roku.

- Only 16% are Pure DTC Subscribers – Despite the ideal nature of this model, pure DTC represents the smallest segment. With the rise of bundling strategies, this number is projected to decline further unless media companies take proactive steps to secure direct customer relationships and data.

These insights underscore the ongoing challenge for streaming services aiming to control more of their revenue streams and customer interactions. While offering certain advantages, bundling strategies complicate building truly DTC businesses. Unless media companies prioritize DTC initiatives, they risk losing control over critical aspects of their business in favor of the platforms that dominate billing and data.

App Stores as the New Gatekeepers

App platforms like Apple, Google, and Roku have taken on a gatekeeping role in the streaming industry. By mandating the use of their in-app purchasing systems, they not only claim a portion of every subscription but also control critical customer data, including payment information, engagement metrics, and personal preferences.

“When users sign up via platforms like Roku or Apple, we lose control over the customer relationship,” said a senior executive from a leading streaming company. “It’s no longer a true direct-to-consumer model. We don’t have full access to customer data, which is critical for personalized marketing and churn management.”

A Product Marketing professional at another streaming service highlighted a related challenge:

“We (obviously) don’t have the data on this, but it’s very likely that someone churns out of our DTC stack and gets our service through a bundle. The data my team looks at shows this customer having fully churned out; however, they might still be a customer of ours, but just getting our content in another way. It’s a marketing black hole for us.”

This is why bundles like Disney’s Disney+, Hulu, and ESPN+ are so significant. They reduce reliance on third-party platforms by incentivizing users to sign up through Disney’s ecosystem, maintaining full control over customer relationships, and avoiding platform taxes. The Disney+, Hulu, and Max bundle also provides a similar advantage, driving users through each service’s existing infrastructure. These moves are part of a broader trend to regain revenue control and increase margins.

The new Starz-BritBox bundle follows a similar strategy. By offering this bundle directly to subscribers and handling the billing internally, Starz and BritBox aim to bypass third-party platforms, retain more subscription revenue, and strengthen their direct-to-consumer offerings.

The Epic Games Comparison

The platform tax debate is not unique to the media space. The dispute between Epic Games and Apple, which centered on Apple’s cut of app revenues, offers a blueprint for what could unfold in the streaming industry. Epic Games pushed back by circumventing Apple’s payment systems, arguing that the 30% fee is anti-competitive. Media companies are watching closely, as this case reflects their concerns about being forced into third-party ecosystems with limited control over revenue sharing.

Just as Epic sought ways to avoid paying platform fees, streaming companies are looking for alternatives, such as encouraging sign-ups through their websites and offering exclusive deals unavailable on third-party platforms.

A New Era of Distribution Disputes

Platform taxes and distribution disputes remain a significant issue in the streaming space. While it’s not the most recent example, the HBO Max dispute with Amazon and Roku stands as the best example in recent history of a content owner pushing back against distribution platforms over customer relationships and platform tax. The standoff, which delayed HBO Max’s availability on two of the largest connected TV platforms, highlighted the increasing tension between streaming services and platform gatekeepers as WarnerMedia prioritized control over its customer relationships and revenue.

As more streaming companies seek to reclaim and protect their profit margins, these types of conflicts may increase in the coming years. The battle is about access and who retains the power over revenue and customer data. This issue is likely to shape the streaming landscape for the foreseeable future.

This article was contributed by Kirby Grines, Ragul Thangavel, and The Streaming Wars Staff.