Last week, I left the UK to visit New York. I was able to take in some cultural sights and sounds, including catching up on some American TV. All around, I was stunned by the prevalence of bundling in everyday life and conversation.

Bundling: A touchdown for State Farm and Verizon

Eighteen months ago, conversations about bundling were constrained to small stages at media and telecom trade shows.

Today, State Farm – one of America’s most prolific advertisers – is running a campaign on TV as a series of commercials featuring one the world’s biggest sports stars, Patrick Mahomes… and it’s all about bundling!

Of all the themes… bundling! Call it a trend, a tailwind it’s here, and it has hit prime time.

As I join the crowds in Times Square, the electronic billboards compete for our attention to the latest shows from streaming services like Netflix, Prime Video, Paramount+ and BritBox, alongside other subscription services like New York Times, many of which are also promoted as bundles.

Walking around the corner, a stand outside a Verizon store promotes YouTube Sunday Ticket, bundled “On Us” when new customers sign up for a mobile plan. Inside the store, multiple content categories can be bundled through Verizon +play, a subscription bundling super-store.

So why is bundling everywhere?

An excellent place to start is to look at the growth of streaming. Since Netflix became a subscription streaming service in 2007, a long list of SVOD (Subscription Video on Demand) services have been created, think Disney+, HBO’s MAX, Amazon Prime Video, and Crunchyroll by Sony, to name a few. These services have rapidly gained popularity, contain much of the best (or at least most heavily promoted) content, and, for many, are the first stop when browsing what to watch.

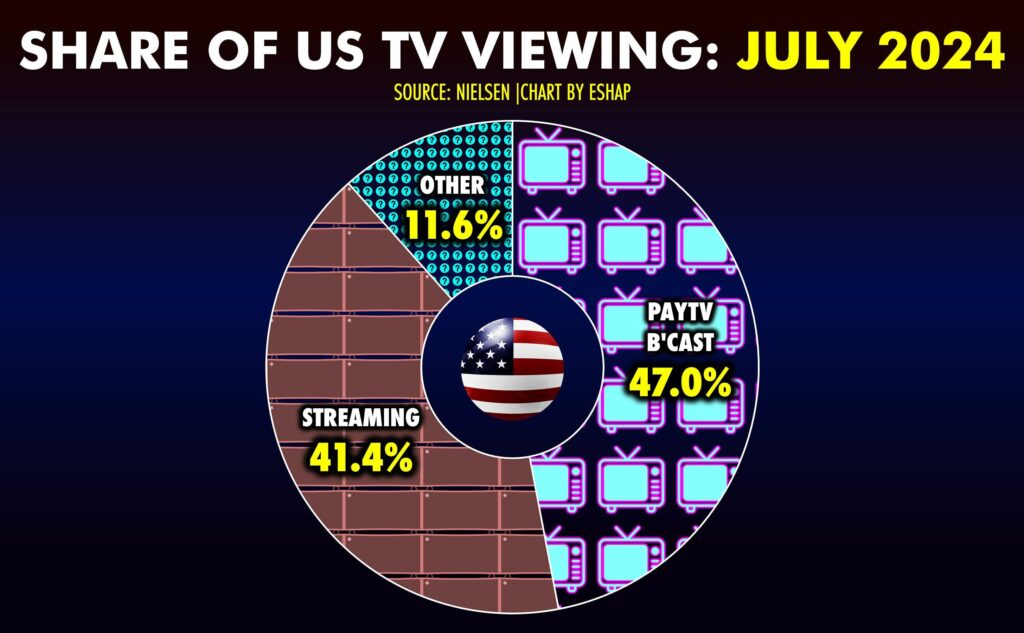

Newly released Nielsen data, visualized by everyone’s favorite media cartographer Evan Shapiro, shows that watching via a streaming service is now almost as popular with Americans as traditional paid TV. This has been an incredible evolution over the past 15 or so years, and has been an exceptionally rapid transformation over the last 24 months.

Read through the news headlines, though, and all is not rosy in SVOD land. Despite the popularity of streaming with consumers, many streamers are fighting for profitability, with continuing user acquisition, reduced churn, and a range of price points on offer all very much needed.

And so, it seems, SVOD is turning to bundling. Omdia research shows that 20% of SVOD globally is already sold through telcos. This new way of engaging with streaming content – through bundles from telcos or with other subscription products, will grow in importance, rising to nearly 50% in some markets such as LATAM by 2028.

Recent data from Antenna shows that of Speciality SVOD (e.g., Crunchyroll), only 9% is sold direct to consumer!

This is a huge and growing trend. And it’s global.

The bundling logic for streamers is clear, but why are telcos turning to bundling? That’s for another article, but let’s summarize by observing a trend that started with bringing together call time, minutes and data into one convenient price plan. Today, telcos observe what their networks are used for, and it isn’t phone calls any more. Consequently the next generation of products bundled, often for free, as a value-add, like the Verizon example above, will be what the consumer wants – TV and movies, games, music, health and well-being.

Bundling is a global trend

Bango (where I work) recently completed surveys of some of the major subscription regions – USA, LATAM and Europe – totalling 16,400 subscribers across 12 countries, which has been summarised in a report launched today and available free here.

In this research we see that in America 20% of subscription products surveyed (not just SVOD) are bought exclusively through indirect channels. This is worth spelling-out – rather than going directly to the source, such as Netflix.com, or Miscrosoft for Xbox Game Pass, 1 in 5 subscribers are now getting all their subscriptions bundled (free or paid for) through another provider. In LATAM, it is already 21% and a staggering 30% in Europe.

The huge trend in subscriptionization (I may have made that up) of the digital economy, I’m talking about the trend for things once sold in boxes for a one off payment, now being sold by recurring payment, a subscription – is touching everything, from SVOD and gaming of course, through to office space, cars, razor blades and toilet tissue. Just about everything you want can be subscribed to as-a-service. The subscription economy is booming and constantly being expanded in scope. The subscriptions economy is nothing if not inclusive.

Subscriptions make the world go ‘round

While many of the world’s most popular subscriptions content originates in the USA, subscriptions are a global trend. In terms of volume of subscriptions, we see in the USA the average subscriber takes 4.5 subs, compared to 3.5 in LATAM and 3.2 in Europe. Curiously, average spend follows a different priority in the USA $924 versus $762 in Europe and $444 in LATAM. One in ten (1/10) USA based subscribers have over 10 subscriptions, and so are ahead of this trend.

However, the data shows some other interesting global trends.

Make Subscribing Great Again

Subscription fatigue is everywhere – in all regions subscribers complain that, for example, there are too many subs to cope with. Annoyed they can’t manage all their subs in one place, between 27-33% of us don’t even know how much we spend each month!

Consequently, the other emerging story consistent in all regions is that subscribers are demanding greater flexibility and control over their subscriptions.

Emerging demand for Super Bundling

Over half of subscribers, in all regions, want one place to pay for and manage all subscriptions. This idea of a single, consolidated, uniform consumer experience for subscription discovery and management is often referred to as Super Bundling. If such content hubs are provided, subscribers will spend more time using their subs and sign up to more. Examples of which are Verizon’s +play and Optus’ SubHub in Australia. They’ll also switch to and be more loyal to the provider of such a service, which they tell us, is ideally their mobile, tv, cable or broadband provider.

This huge trend toward streaming and SVOD is in the medium term at fast changing the media landscape and fuelling the growth in the subscription economy, which Juniper Research is estimating to be worth $1 Trillion by 2028 (from $593B in 2024).

Content. Are we content?

Back to New York, overloaded with advertising about what I might watch back in the hotel, I’m on my way to see the new play Stereophonic with music by Arcade Fire’s Will Butler, which reminds me of the lyrics to one his songs: “Infinite content, infinite content, we’re infinitely content”. Spoiled by so much choice, are we?

Download the new research from Bango here.