In the early years of the streaming boom, platforms competed by offering exclusive shows, blockbuster movies, and must-see originals. But in 2025, consumer behavior reveals a shift in priorities. According to Hub Research’s Best Bundle report, the deciding factor for subscribers is not just what content is available, but how services are packaged, priced, and managed.

Bundles Make a Comeback

Throughout 2024, the streaming market evolved in unexpected ways. Competing platforms began joining forces within bundled offerings, while services like Amazon and Roku grew in popularity as subscription aggregators. These aggregators allow users to select, manage, and pay for multiple streaming services through one interface.

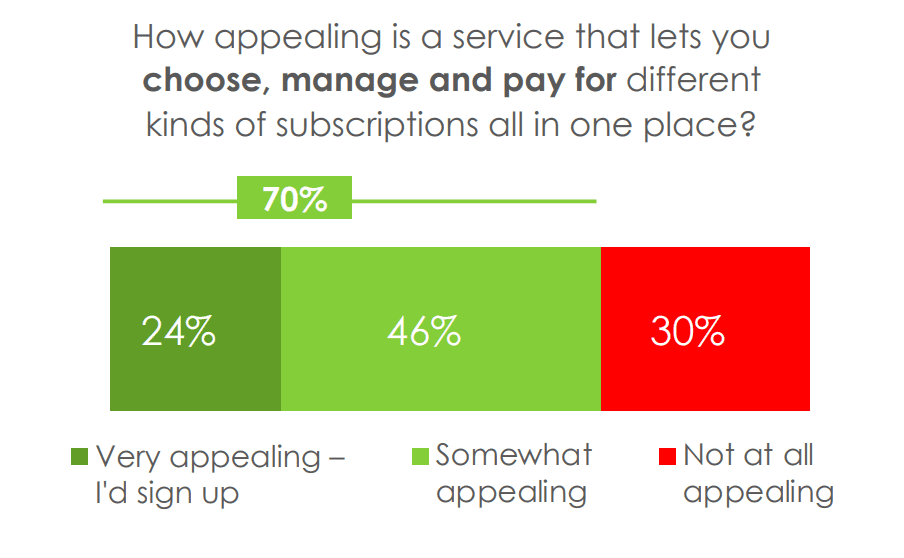

The appeal is widespread. 70% of consumers find this kind of service appealing. Of those surveyed, 24% said such a solution is very appealing, 46% found it somewhat appealing, and only 30 % said it was not appealing at all.

On average, users who subscribe through an aggregator have 6.6 total paid subscriptions, compared to just 3.7 for those who subscribe independently. Aggregation not only simplifies access but also encourages more extensive usage of paid services.

Service Usage Has Plateaued

Despite the growing number of platforms available, the average number of services used by each viewer has stopped increasing. In 2023, viewers reported using an average of 6.4 sources. That figure climbed to 7.4 in 2024, but fell again in 2025 to 6.3.

This decline is driven largely by economic concerns. Inflation and rising subscription prices have made households more cautious about the number of services they pay for. As a result, viewers are consolidating their subscriptions and seeking more affordable options.

Viewers Are Cutting Back on the Big Players

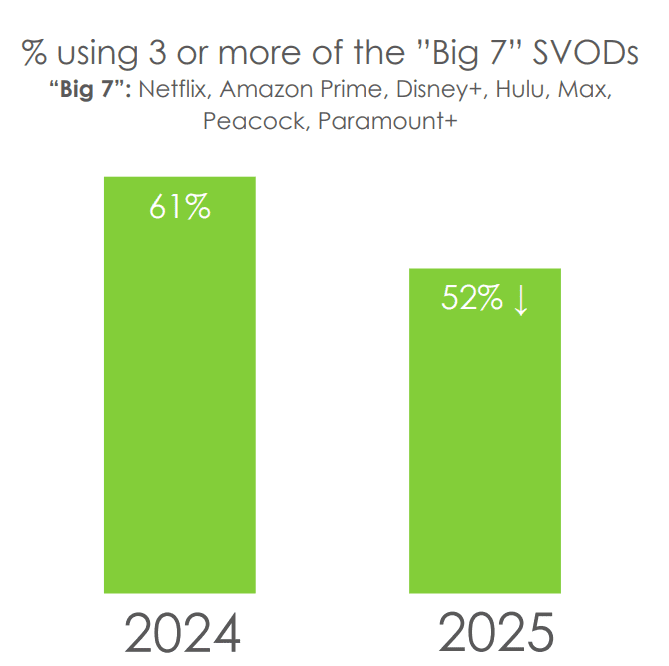

The “Big 7” SVOD services, Netflix, Prime Video, Disney Plus, Hulu, Max, Peacock, and Paramount Plus, have all felt the impact. In 2024, 61 % of viewers said they used three or more of these services. By 2025, that number had dropped to 52 %. This drop highlights a growing sense of subscription fatigue, especially when the content libraries of each service overlap or become overwhelming.

Perceived Value Is Declining

As households re-evaluate their media budgets, perceptions of value are shifting. In 2024, 65 % of users said they felt they received excellent or good value for what they spent on TV services. That number declined to 60 % in 2025. Meanwhile, the share of users who rated their services as fair or poor increased from 35 % to 39 %.

This change in perception reflects a growing frustration among users who feel that rising prices are not always matched by better viewing experiences or improved content offerings.

Content Alone No Longer Sells Subscriptions

One of the most significant shifts revealed by the study is in how consumers choose new services. Among those who started using a new streaming service in the past year, only 19% said they were motivated by exclusive titles, and 16% cited a specific show or movie. By contrast, 21% said they signed up because of overall value, and another 21% pointed to package deals.

Other motivators included promotional offers (15%) and access to old favorites (14%). While content remains a factor, convenience and cost-efficiency have taken the lead in driving new subscriptions.

Free Services Are Gaining Ground

While paid platforms wrestle with subscriber churn, free ad-supported platforms are gaining popularity. Services like YouTube and Tubi are now more widely used than many paid streamers. Viewers no longer view free platforms as second-tier alternatives. Instead, they are seen as practical, cost-effective options that offer sufficient content without the burden of a monthly bill.

Even Cable Is Changing

Traditional cable providers are also adapting to this new reality. After years of complaints about oversized, expensive bundles, MVPDs have begun offering mini-bundles that let viewers choose the content they want. This move brings legacy television closer to the flexibility that made streaming attractive in the first place.

These smaller, customizable bundles help traditional TV stay competitive, offering an answer to the “too much for too little” sentiment that has plagued the cable industry.

A New Definition of the Best Bundle

The broader trend is clear. Consumers are not expanding their TV usage any further. The number of services they use has dropped slightly, and their choices are now guided by affordability, convenience, and control.

The platforms that succeed in this environment will not be the ones with the most original shows or the largest content libraries. Instead, they will be the ones that offer smart packaging, fair pricing, and simple access.

In 2025, the best bundle is no longer the one with the most content. It is the one that makes television easy to manage, reasonably priced, and tailored to what viewers want.

Summary:

Hub Research’s 2025 Best Bundle report reveals a pivotal shift in streaming behavior—viewers now prioritize affordability, convenience, and package flexibility over exclusive content. Bundling and aggregation are gaining traction, as consumers consolidate subscriptions to combat rising costs and subscription fatigue.

Categories:

- Insights (Double check that this is accurate)

- Bundles

- Subscriptions

- Industry

- Business

Tags:

Hub Research, streaming bundles, streaming trends 2025, subscription aggregation, SVOD, AVOD, streaming fatigue, media value perception, streaming subscriptions, free ad-supported TV, Tubi, YouTube, cable mini-bundles, consumer behavior streaming