Roku has dominated the U.S. connected TV market for years. But with global rivals like Samsung gaining ground—and Roku absent from most international markets—the question isn’t if its lead will slip. It’s what happens when it does.

Roku Leads in the U.S. But Samsung Is Catching Up

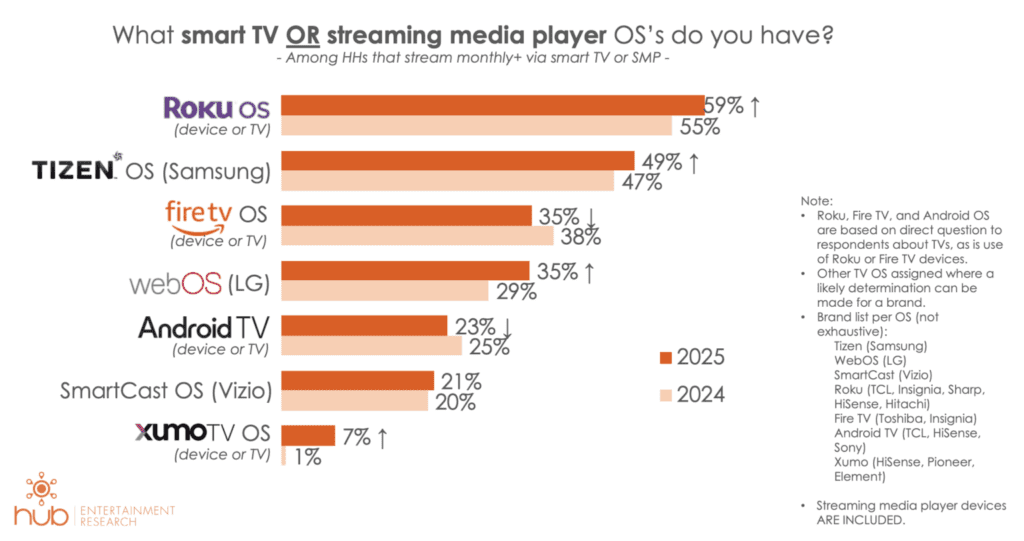

Roku OS is in 59% of American households, according to Hub Entertainment Research. Samsung’s Tizen OS isn’t far behind at 49%. Amazon’s Fire TV and LG’s webOS follow, each powering 35% of connected TV devices in the U.S.

Pixalate’s Q4 2024 market share report reinforces Roku’s lead, crediting the platform with 39% of U.S. programmatic ad transactions. But Samsung is the one picking up speed, notching a 51% year-over-year growth rate.

Parks Associates also notes that Samsung leads in U.S. smart TV ownership with 37% of households, while Roku TV trails with 18%—a figure that reflects just Roku-branded TVs and not its broader set-top box footprint, where Roku is far more competitive.

Together, the data paints a picture of a narrowing gap. Samsung’s deep integration of hardware and software—and its global brand muscle—make it the most formidable challenger to Roku’s U.S. dominance.

Roku’s Global Footprint Is Weak

Roku’s grip on the U.S. remains firm, but its global standing is far more precarious—especially as Samsung surges in regions where Roku barely shows up.

Pixalate’s Q1 2025 report shows Roku leading North America with 38% share of voice (SOV), trailed by Amazon Fire TV at 18%, Apple TV at 13%, and Samsung at 12%. But outside the Western Hemisphere, Roku is fighting for scraps.

In EMEA, Samsung and LG are tied at the top with 25% SOV. Roku sits in fourth place at just 11%. Amazon holds 13%, while Xiaomi closes out the top five with 5%.

APAC tells a similar story: Samsung leads at 24%, Xiaomi follows at 17%, and Roku is third with 14%. Apple TV and TCL round out the list. Even in the UK, Samsung leads with 30% SOV, while Roku trails at 20%.

The contrast is stark. Roku is dominant in North America and holds 48% SOV in LATAM and 35% in Canada. But elsewhere, it’s either losing ground—or already lost it. If current trends hold, Samsung won’t just win on global unit sales, it’ll seize the upper hand in ad power and platform influence too.

Inside Roku’s International Strategy—and Its Retreat

Roku once had real ambitions to go global. The company pushed into key international markets, signed deals with local telecoms and content providers, and tried tailoring its platform to regional needs.

But insiders point to misfires in execution and a lack of executive commitment. Without a clear vision, internal alignment suffered. Key hires departed. Resources were misallocated—including a 400-person Amsterdam office that launched without a monetization strategy.

In Europe, where long-term broadcaster partnerships are essential, Roku failed to gain traction. Technical hurdles also slowed adoption. In Brazil, partners struggled to find developers fluent in Roku’s proprietary BrightScript language, stalling integrations.

Eventually, Roku pivoted toward easier wins in Latin America—markets with lower barriers to entry and faster user growth. But the tradeoff was clear: a retreat from Europe and other strategic regions with higher long-term upside.

Roku’s Remaining Strongholds

Roku still holds solid ground in Mexico and Brazil, where its brand resonates and local content deals support growth. In Canada, cultural overlap with the U.S. helps sustain share. In the U.K., its presence relies more on existing hardware partnerships than active expansion.

But the story elsewhere is one of quiet withdrawal. Roku has pulled back from Australia and Europe, suggesting a focus on near-term gains over global durability.

What’s at Stake for Roku

Roku’s international retrenchment reveals something deeper: a company prioritizing quarterly wins over long-term positioning. That’s left space for Samsung, LG, and others to secure international strongholds—and for emerging challengers like TiVo OS, Amazon’s Vega OS, and the soon-to-launch Ventura OS to crowd the field.

As connected TV shifts from local battles to a global game, Roku’s patchy footprint looks less like a delay and more like a liability.

If Roku loses its edge in the U.S., its lack of global scale becomes a structural weakness. Insiders warn that without a rebooted global push, Roku could go from market leader to regional holdout. And even its home-field advantage may not last forever.