Ad-supported streaming isn’t just the future of CTV—it’s the foundation. But the real story isn’t reach. It’s revenue. The next frontier isn’t about how many viewers see an ad. It’s what they can do with it.

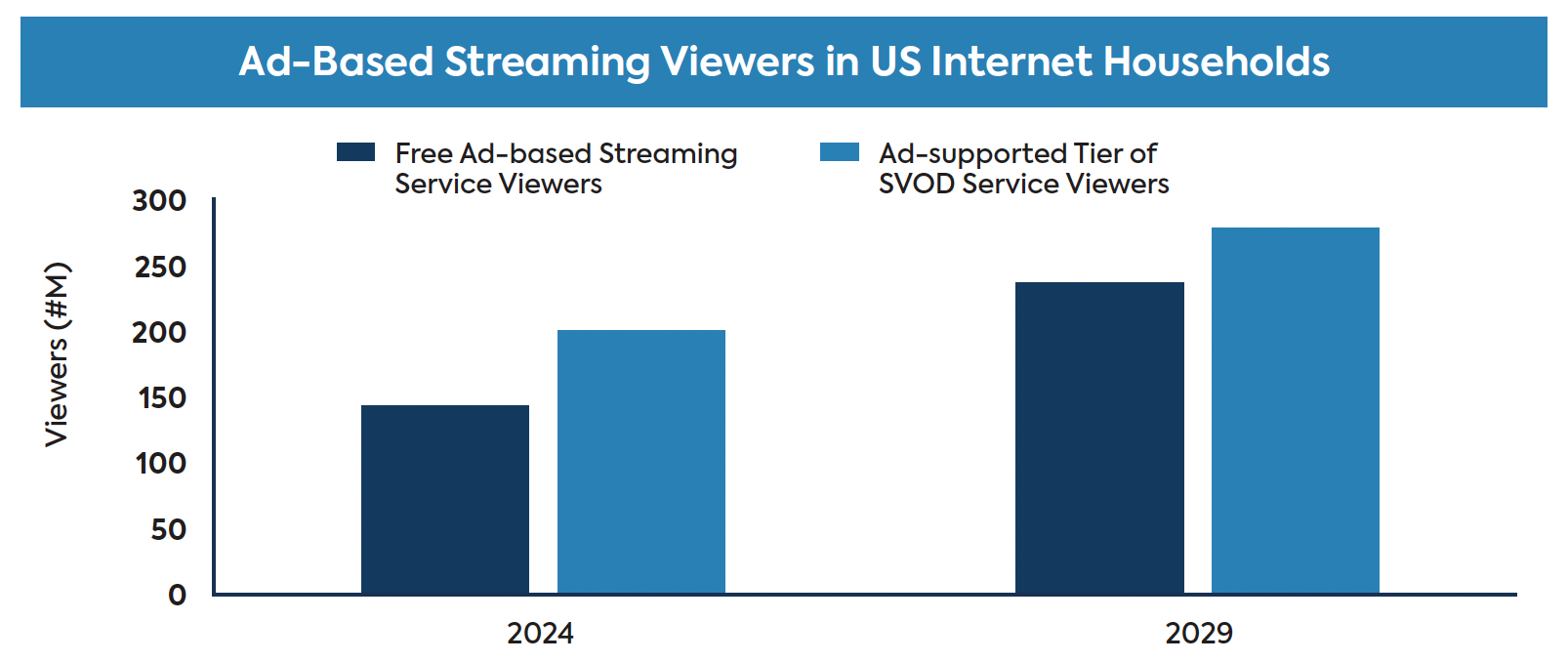

According to Parks Associates, subscription video (SVOD) services are projected to reach 278 million U.S. viewers by 2029, while free ad-based platforms will attract another 236 million viewers. With Nielsen estimating 315 million total TV viewers nationwide, more than 88% of U.S. audiences will consume ad-supported content within the next four years. These numbers reflect more than a shift in viewing habits. They mark a fundamental redefinition of what TV can be—not just a passive medium, but a gateway to interaction and commerce.`

This rise comes as services face intensifying pressure to turn a profit. The average U.S. household now subscribes to 5.5 streaming services. As ad-free tiers grow more expensive, users are turning to cheaper, ad-supported options. Parks Associates data shows that 82% of U.S. internet households now view streaming ads across free platforms, ad-supported SVOD, and live TV services (vMVPDs). Specifically:

- 59% subscribe to ad-supported SVOD tiers like Netflix, Disney+, or Peacock

- 47% watch free ad-based platforms like Tubi, Pluto TV, and The Roku Channel

- 22% subscribe to vMVPDs like YouTube TV, Hulu + Live TV, or Philo

Ad-based plans have quietly become the default. 75% of Peacock and 70% of Hulu users are on ad-supported tiers. Amazon made ads the default in early 2024. More than 50% of new Netflix subscribers in ad markets now choose the ad tier. Disney’s ad-supported services now reach 157 million monthly active users globally—112 million in the U.S. and Canada.

The Satisfaction Gap—and the Opportunity

Despite their ubiquity, ad-supported plans trail ad-free in customer satisfaction. Net Promoter Scores for ad-supported services lag by up to 25 points. That gap is a wake-up call. Platforms can’t just push cheaper plans—they need to improve those experiences.

Enter interactivity. Rather than viewing ads as interruptions, platforms are exploring ways to turn them into meaningful, personalized engagements that mirror social and mobile habits.

Social Behavior Built This Moment

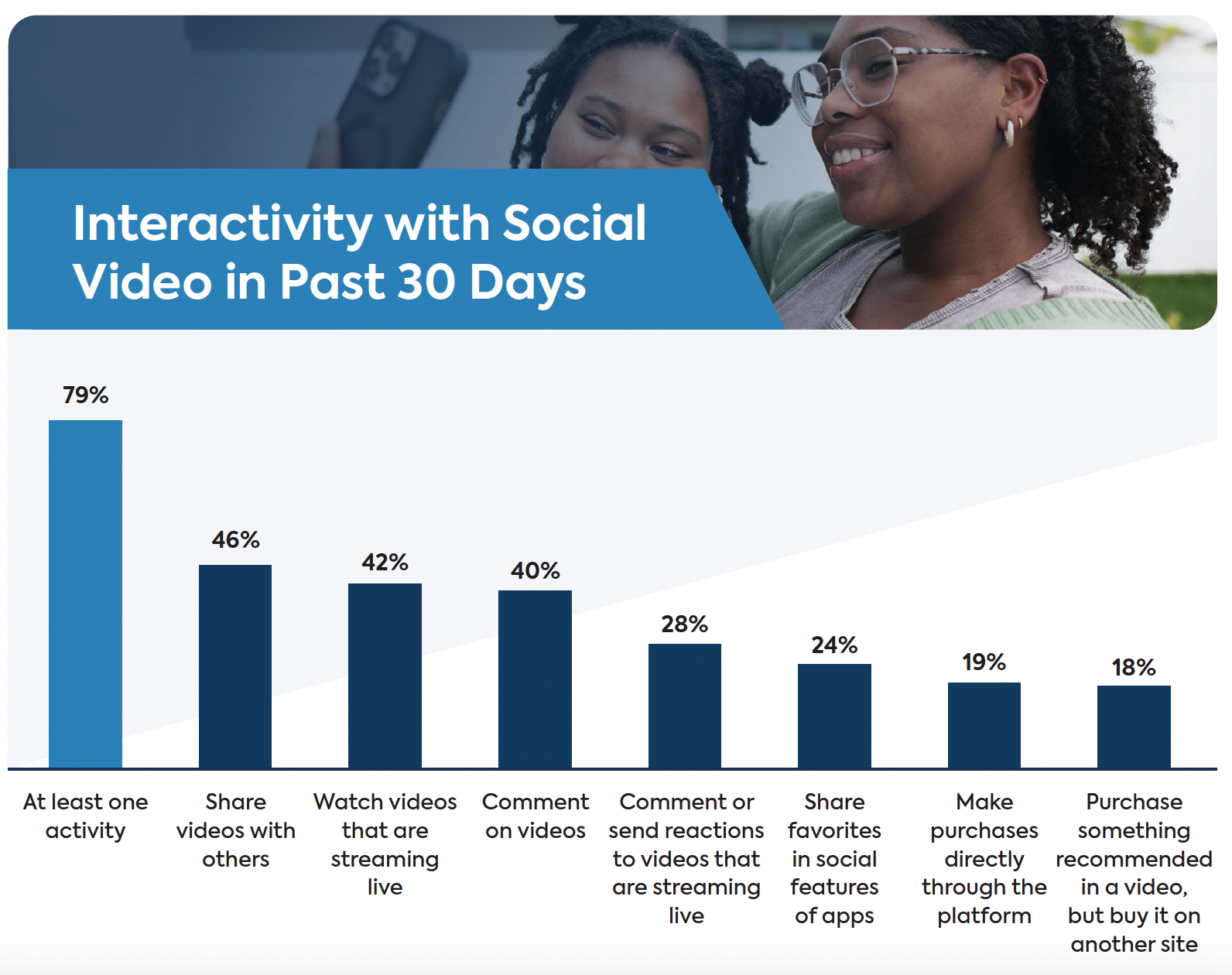

Interactive TV is a logical next step for how people already engage with video content online. Interaction is the default on platforms like YouTube, TikTok, and Facebook. Parks Associates finds that 79% of U.S. internet households that watch social video interact with it in some way:

- 46% share videos

- 19% make purchases directly through the platform—about 18 million households

Another 19% report buying something they saw in a video, even if they completed the transaction elsewhere. The muscle memory is already there. The challenge for CTV is designing formats that make action seamless.

Shoppable TV Is Already Here

CTV platforms are responding. Roku’s Action Ads let users click prompts like “OK-to-email” or “OK-to-checkout.” YouTube offers clickable overlays, dynamic end screens, and call-to-action buttons. Fubo has rolled out transactional ads, gamified formats, geo-targeting, and rotating carousels.

According to Parks Associates, 7.5 million households—8% of those with a CTV device—bought a physical product through their TV in the past 30 days. 42% of households have completed at least one commerce-related activity via their TV: renting or buying content, subscribing to services, or shopping via TV-based interfaces.

More than half of U.S. internet households say they will likely take commercial action through CTV. Viewers are ready to order food during a program, shop for merchandise, or click on time-sensitive deals.

Sports Are the Trojan Horse

If any genre is tailor-made for real-time interaction, it’s sports. Sports viewers make up 43% of U.S. internet households. Within that segment, 32% say they’re interested in placing bets directly through a streaming service—before or during the game. As more sports content moves to streaming, the incentive to fuse viewing with commerce only grows.

The Second Screen Advantage

People aren’t just watching—they’re browsing, texting, and shopping. 89% of U.S. internet households shop online at least once a month, and mobile now dominates e-commerce.

CTV advertisers are tapping into this with:

- QR codes (including invisible ones)

- Push notifications

- In-app prompts

Voice assistants and smart remotes are adding another layer. With voice, users can search, purchase, or navigate options without reaching for a keyboard. As TVs get smarter, friction disappears.

The Bigger Picture: CTV as Digital Hub

Shopping is just the start. TVs are quickly becoming command centers.

- 30–45% of viewers are interested in social features like live polls, watch parties, and chat

- 64% of households with security systems want to view doorbell or camera feeds on their TVs

- Cloud gaming platforms like Xbox Game Pass and Amazon Luna are turning TVs into multiplayer consoles—no hardware needed

The television is becoming the interface for your entire digital life.

Barriers to Adoption

Of course, there’s friction. Most CTV interfaces were built for passive viewing. Navigation still depends on clunky remotes. Voice and app integration help—but aren’t universal.

Privacy is another hurdle. 80% of users have at least one concern about interactive features, and nearly half cite personal data or payment security. For advertisers, fragmentation across devices and platforms makes it hard to scale campaigns or measure them consistently.

What Needs to Happen

To unlock CTV’s full potential:

- Platforms must treat smartphones as part of the TV experience

- Interfaces need to simplify interaction across age groups

- Trust must be built through secure, seamless checkout systems

- Voice, QR, and mobile prompts must reduce friction, not add it

- Commerce shouldn’t feel like a bolt-on—it should feel native

The Take

Interactive and shoppable TV isn’t theoretical. It’s happening. As ad-supported streaming becomes the norm, expectations around what ads can do are changing fast. For platforms, this unlocks a new monetization layer. For advertisers, it delivers real-time outcomes. And for users, it turns passive watching into something actionable.

The screen isn’t just smarter. It’s clickable. And that changes everything.