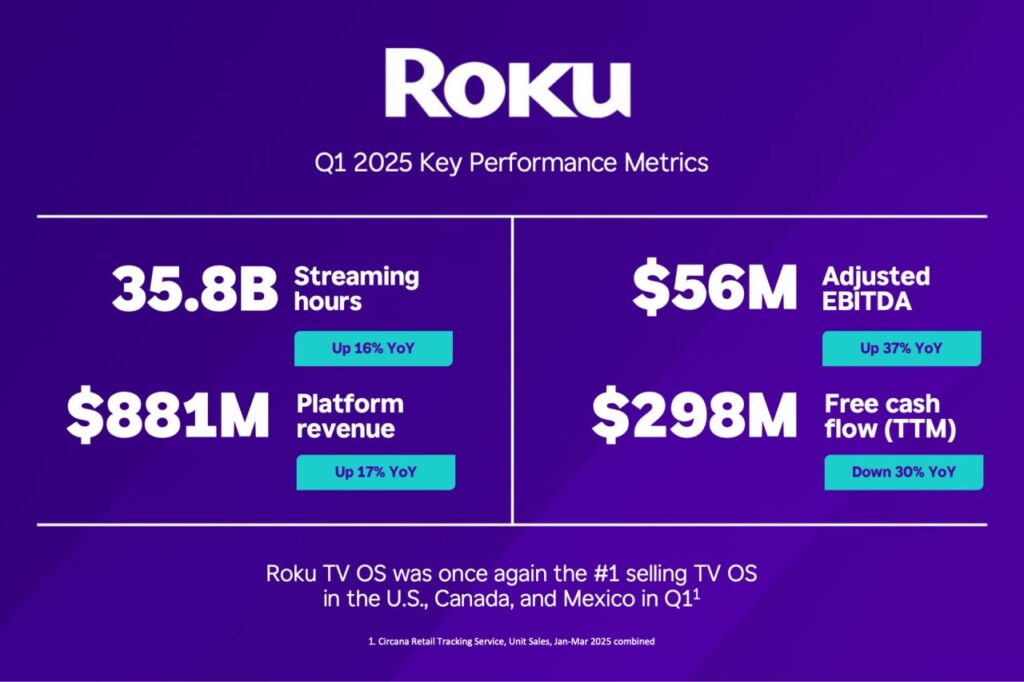

Roku, the #1 CTV OS in the United States but not as much internationally, beat expectations in Q1. Revenue hit $1.02 billion, up 16% year-over-year. Platform revenue led the way with $881 million, up 17%, driven by advertising and subscription distribution. Streaming hours rose to 35.8 billion. Device revenue also grew by 11% year-over-year, but that won’t last. Tariffs are back, and Roku is projecting a 10% drop in device revenue next quarter.

The company reiterated its full-year outlook for $3.95 billion in platform revenue and $350 million in adjusted EBITDA. It still expects to reach positive operating income by 2026.

That’s the top-line story. But the real strategic signal came from its $185 million acquisition of Frndly TV.

Why Frndly Matters

Frndly TV is a low-cost virtual multi-programming video distributor (vMVPD) offering a family-friendly channel lineup, including Hallmark, Lifetime, and History, with low churn. It’s not a prestige content play—it’s a business model acquisition. The value is in direct billing, subscriber ownership, bundling potential, and a sticky content loop that complements Roku’s free, ad-supported model.

Roku now controls another piece of the value stack: a live, subscription-based product it can package into its platform, promote on the home screen, and sell through its billing infrastructure, Roku Pay.

The deal includes a $75 million performance-based earn-out, signaling that Roku sees long-term upside if Frndly meets its targets.

Platform Leverage

Roku is positioning itself to monetize every layer of the streaming experience—from ad impressions to subscription billing to UI engagement. Its content row and discovery tools are driving viewership inside The Roku Channel, now the No. 2 app on the platform in the U.S. Streaming hours there rose 84% YoY. Ad revenue is growing faster than the broader U.S. streaming video market.

That’s not just engagement—it’s monetizable scale.

The device business remains a risk. Assembled in China, Roku hardware is directly exposed to U.S. tariff policy. A hit to devices would slow new user growth, potentially dragging platform metrics over time. But for now, platform engagement and monetization are offsetting those headwinds.

The Take

Roku is using this period of macro uncertainty to consolidate its position as a platform-first business. The Frndly TV acquisition isn’t a content play—it’s a monetization strategy. Direct subscribers, low churn, and bundling upside align with Roku’s focus on revenue diversification and control of the streaming stack. Hardware may slow, but the platform is built to scale.