If there’s one thing streaming executives love more than a recurring subscription fee, it’s live sports. Parks Associates’ latest study, Streaming Sports: The Fan Experience, confirms what we’ve been watching unfold in real time—sports content is becoming the backbone of streaming strategies, fueling engagement, retention, and, of course, higher subscription prices.

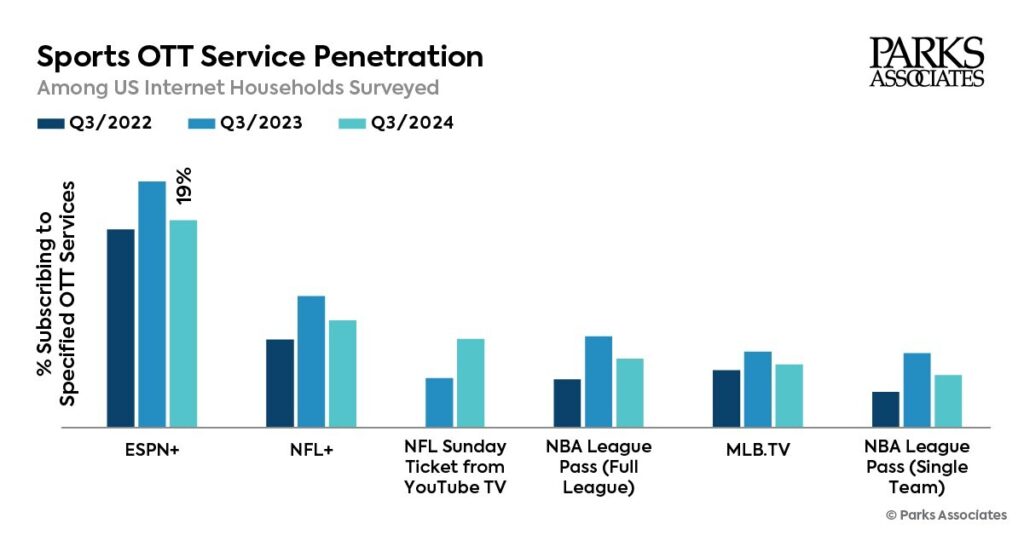

According to the report, 33% of U.S. internet households now subscribe to direct-to-consumer (D2C) sports services, and traditional sports fans who rely solely on cable are an endangered species, making up just 8% of viewers. ESPN+ continues to dominate the sports streaming space with a 19% penetration rate, followed by NFL+ at 10%.

But let’s be real—the bigger story isn’t just about these niche sports platforms. It’s about how streaming giants like Disney+ and Netflix are reshaping their entire content strategies to go after live sports. And with a 72% surge in sports programming across major SVOD services in Q1 2025 (per Gracenote), this isn’t a casual pivot. It’s an all-out arms race.

Disney+ and Netflix: The New Heavyweights in Sports

Disney+, once the home of family-friendly blockbusters and The Mandalorian, has now muscled its way into the sports streaming conversation. Thanks to its integration of ESPN programming, Disney+ now accounts for 33% of available sports content, nearly matching Amazon Prime Video’s 35% share. Just a quarter ago, Amazon had a stranglehold on sports content with 54%—but the balance of power is shifting.

And then there’s Netflix. The company that swore it would never touch live sports is now responsible for 23% of all sports programming in streaming. The success of Formula 1: Drive to Survive and its copycat follow-ups (Quarterback, Full Swing, etc.) made one thing clear—sports fans want more than just highlight reels. They want storytelling, behind-the-scenes access, and, increasingly, live events.

Netflix is testing the waters with one-off live events like last year’s NFL Christmas Day games and the upcoming Mike Tyson vs. Jake Paul boxing match. And while CFO Spencer Neumann insists Netflix isn’t ready to outbid CBS and Fox for full-season rights, the company didn’t flinch at paying $150 million for a single NFL game last year. The message is clear: they’re in the game now.

The FAST Factor: Free Sports for the Win

Subscription-based streaming services aren’t the only ones making moves. Free ad-supported streaming TV (FAST) platforms rapidly expand their sports content, with live sports emerging as the next major battleground.

Fox shocked the industry by streaming Super Bowl 59 for free on Tubi, drawing 13.6 million viewers and proving that FAST platforms can attract massive audiences with premium live sports. Meanwhile, Roku is doubling down with a new premium sports FAST channel, featuring live MLB and Formula 1 events.

The numbers speak for themselves:

- 220 dedicated FAST sports channels exist today—up 105% since mid-2024.

- Reality TV and sports are now the fastest-growing FAST genres, with reality TV channels exploding by 626% in the last year.

- Live sports is becoming a differentiator for FAST, just as it once was for cable TV.

FAST’s biggest challenge? Discovery. With so many channels offering non-exclusive content, the user experience remains a mess. According to Gracenote, nearly a third of FAST programs lack proper genre classification, while 66% don’t even have production country metadata. Without better categorization and search functionality, casual sports fans won’t know where to find live games—and that’s a big missed opportunity.

Max’s Sneaky Sports Move

While Disney+ and Netflix fight over sports dominance, Warner Bros. Discovery’s Max is quietly playing the long game. Originally planning to charge extra for its Bleacher Report (B/R) Sports add-on, WBD reversed course, keeping sports content within Max’s Standard ($16.99) and Premium ($20.99) tiers.

It’s a savvy move. Instead of trying to convince users to pay an extra $9.99 for B/R Sports, Max is using sports as an incentive to push subscribers toward its higher-priced tiers—just as Netflix locks downloads behind its ad-free plans and Disney+ reserves 4K for premium users.

Meanwhile, ad-supported Max users ($9.99/month) are losing access to live sports entirely. Why? Because streaming sports rights are expensive, and WBD knows that sports fans are more willing to pay.

The Bottom Line: The Sports-Streaming Arms Race Is Just Getting Started

If Q1 2025’s 72% increase in sports streaming content tells us anything, it’s that platforms aren’t just experimenting with sports anymore. They’re building their entire retention models around it.

Disney+ is no longer just a home for Marvel and Frozen sequels—it’s a serious player in live sports. Netflix is no longer just a binge-watch destination—it’s eyeing “eventized moments” (read: expensive sports rights). FAST isn’t just a dumping ground for old sitcoms—it’s proving live sports can work at scale.

The old rules of sports broadcasting are dead. The real question now? Which streamer will win the war for sports fans’ loyalty—and their wallets?