I’m going to zig where everyone else is zagging this week.

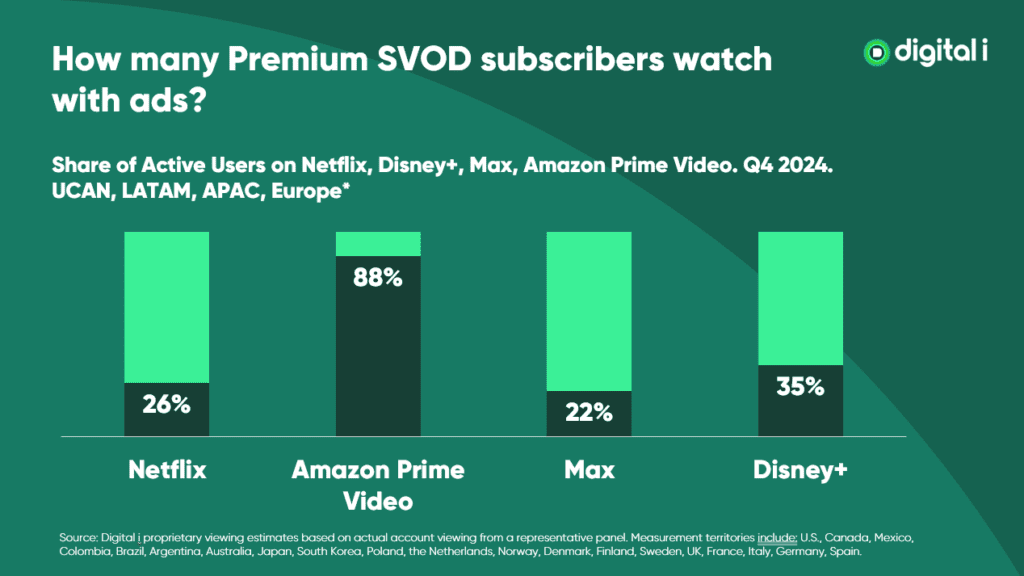

You may have heard that, according to a third-party estimate, 88% of Prime Video users are watching ads. But let’s flip that script: only 12% care enough to pay to skip them. And that stat? That’s not an indictment of Amazon’s strategy. That is the strategy. It’s a quiet, ruthless, Wall Street-pleasing flex dressed up as a user experience update.

While Netflix, Disney+, Max, and virtually every other streamer carefully launched cheaper ad-supported tiers to court price-conscious users, Amazon took a look at all that nuance and said, “Nah.” Instead of offering a new plan, they changed the entire plan. Overnight, Prime Video became ad-supported by default. No discount. No opt-in. Just a “you want ad-free? That’ll be $3 extra.”

And just like that, Amazon built one of the largest ad-supported video platforms in the world without altering its price structure or engaging in a churn war. That’s not innovation—it’s domination disguised as convenience.

Of course, social media had its usual meltdown. “I’m done with Prime Video!” “This is outrageous!” “I’m not paying more for less!” But here’s the truth: most of those people never left. They’re still watching “Reacher,” “The Boys,” “Fallout,” “Upload,” and whatever new franchise Amazon is reverse-engineering from a data set. They just sit through the ads now, like everybody else.

And why wouldn’t they? Prime Video isn’t a standalone product—it’s a sticky appendage of the Amazon Prime mothership. You get your free shipping, your Whole Foods discounts, and yes, a streaming service that delivers original content and back-catalog comfort food with just enough friction (i.e., ads) to make $3/month sound like a deal. This isn’t a traditional streamer. It’s Trojan Horse TV,

The Digital-I report that kicked off all this fuss is actually worth your time. It covers multiple regions and makes some solid points: ad-free viewers do watch more, especially on Netflix, where they clock in an extra 24 minutes per day. But here’s the twist—Amazon isn’t playing that game. It doesn’t need you to binge Prime Video. It just needs you to exist inside the Prime ecosystem long enough for AI to glance at your order history and quietly confirm to HQ: “Yeah, this one’s not going anywhere.”

And let’s be honest: who’s really canceling Prime over three bucks—or a few ads in the middle of “Fallout”? If you’re already dropping $139 a year for free shipping and same-day dog food delivery, you’re not sweating the upgrade—or the inconvenience of a couple ad breaks. Either way, Amazon wins. It’s not just monetizing loyalty—it’s monetizing indifference.

No one else can run this play. Netflix and Disney+ are still figuring out how to balance price, value, and viewer expectations. Amazon? It’s busy turning shipping customers into ad inventory. And they didn’t need to lower the price, flood the press with rollouts, or brace for subscriber loss. They just… did it.

And let’s not overlook what this means in the long term. This is Amazon carving out a moat. As more streamers bleed cash chasing viewer loyalty, Amazon is leveraging the absence of loyalty. Prime subscribers don’t stay for the content—they stay for the free two-day delivery. And as long as Prime Video remains a bundled benefit, Amazon can keep experimenting, iterating, and yes, slipping in more ads—because no one’s leaving over a few pre-roll spots before “Mr. & Mrs. Smith.”

So yeah, only 12% of users are paying for ad-free Prime Video. That’s not a warning sign. That’s proof that Amazon doesn’t need to sell you on content—it already sold you on convenience. And now it’s selling you to advertisers.

It’s not apples to apples. It’s apples to guanabanas. And Amazon? It owns the whole fruit stand.