For years, the battle for streaming dominance was framed as a Subscription War—streaming services fighting for direct relationships with consumers, pushing exclusivity, and trying to lock in loyalty. That war is over. In its place, a new model is taking over: the bundle economy.

I’ll admit it—when I first got into this space in 2009 through my app development company, Float Left, direct-to-consumer (DTC) fired me up. The idea that media companies could bypass the middleman, own the customer relationship, and control their own revenue streams spoke directly to my punk rock ethos. No gatekeepers, no toll booths—just pure, direct access between content and audience.

Sixteen years later, there’s still some DTC in video, sure. But let’s be real: this is a bundler’s world. You’re either the bundler, the bundlee, or sometimes both.

According to new research from Bango, a seismic shift is underway in how Americans subscribe to digital services. More than two-thirds (68%) of U.S. subscribers now get at least one of their subscriptions through a bundle or indirect channel . The days of managing multiple standalone subscriptions are fading—consumers want simplicity, flexibility, and cost savings.

And they’re getting exactly that from telcos, retailers, and payment platforms, which are rapidly becoming the new power players in the subscription business.

What does this mean for the future of streaming, gaming, and digital subscriptions?

It means services that adapt to this shift—rather than fighting to maintain outdated DTC models—will be the ones that thrive.

Bundles Are Now the Default, Not the Exception

Bango’s “Subscriptions Assemble” report, based on a survey of 5,000 U.S. consumers, reveals how quickly the DTC model is losing ground.

- The average American pays for 5.4 subscriptions, but two of them are now acquired through bundles or indirect deals.

- 55% of subscribers get at least one service through their cell phone provider.

- 34% access subscriptions through a retailer like Walmart (Walmart+) or Amazon (Prime).

This is not just about streaming services—it’s happening across all digital subscriptions, including music, gaming, fitness, and even AI.

What’s Driving the Shift?

- Cost Savings – 44% of subscribers now receive a service for free through a bundle that they previously paid for. Among Gen Z (18-24), that number jumps to 55%.

- Convenience – 41% of subscribers are frustrated they can’t manage all their subscriptions in one place.

- Flexibility – Nearly two-thirds (63%) want a single app to manage all their streaming and subscription services.

Rather than fighting for individual sign-ups, services that integrate into bundles are gaining access to millions of new customers—without the direct marketing and churn risks of standalone subscriptions.

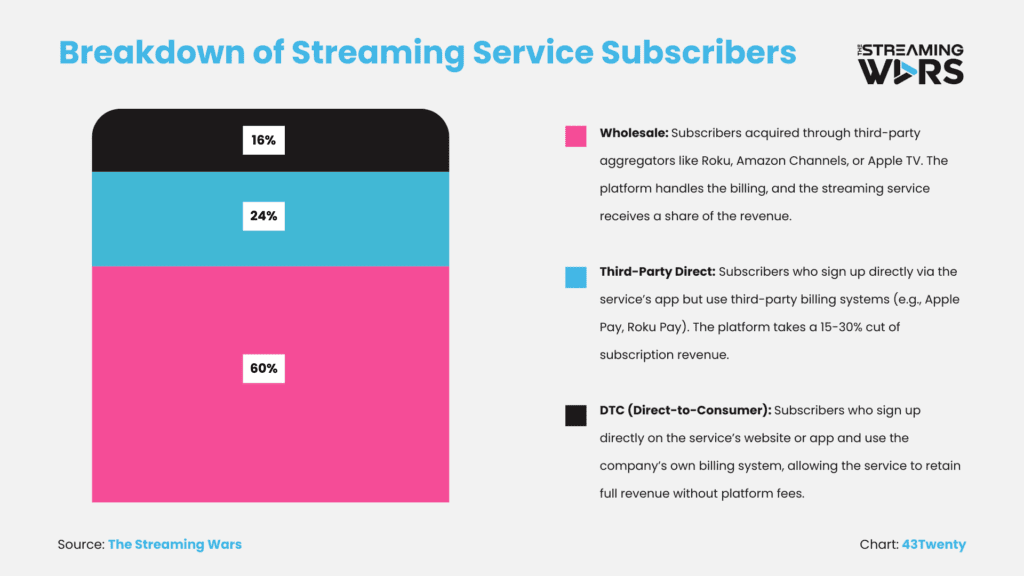

DTC Is Shrinking: Only 16% of Streaming Subscribers Go Direct

For streaming services, the reality is clear: DTC subscriptions are no longer the dominant acquisition method. This was highlighted via our previous research at The Streaming Wars.

Subscriber Breakdown

- 60% subscribe through wholesale aggregators (Roku, Amazon Channels, Apple TV).

- 24% subscribe via third-party direct billing (e.g., Apple Pay, Roku Pay).

- Only 16% subscribe directly via the service’s website/app and use the platform’s own billing system.

This reliance on third-party distribution creates both opportunities and challenges:

- More Reach: Bundles and aggregators open doors to new audiences without aggressive marketing spend.

- Less Control: Platforms like Apple, Amazon, and Roku take a 15-30% revenue cut and limit subscriber data access.

Why This Matters:

Services that still prioritize DTC will struggle to compete on cost and convenience. Consumers are voting with their wallets—and they’re choosing bundles and aggregation over standalone subscriptions.

Super Bundling Is the Next Frontier

While bundling has been around for years, Super Bundling is what’s coming next. Instead of just offering a handful of services, Super Bundles allow telcos, banks, and retailers to create centralized subscription hubs, giving consumers one place to:

- Sign up for multiple services in a single transaction.

- Manage subscriptions across different providers.

- Consolidate billing into a single monthly charge.

Examples of Super Bundling in Action:

- Verizon +Play (U.S.) – Offers bundled subscriptions including Netflix, Max, Paramount+, and more.

- Optus SubHub (Australia) – Combines Netflix, Amazon Prime, YouTube Premium, and more in a single package.

- Banks & Wallets – 23% of U.S. subscribers now access subscriptions through payment platforms, a trend expected to grow.

This isn’t just about making things easier for consumers—it’s also a huge win for services that join these bundles.

- Super Bundling unlocks scale without requiring streaming services to overspend on marketing.

- It reduces churn by keeping subscribers inside a broader ecosystem.

- It increases lifetime value by offering more flexible ways to subscribe and pay.

For services, the key question is no longer ‘Should we bundle?’ It’s ‘How do we integrate into the best bundle ecosystem for our audience?’

So who Wins in the Bundle Economy?

The shift toward bundling is reshaping the power dynamics of the subscription industry. The winners will be those who embrace aggregation, scale through partnerships, and prioritize convenience—while those clinging to outdated, rigid models risk being left behind. Here’s who stands to gain and who stands to lose in this new era:

Winners:

- Telcos, Banks, and Retailers – They’re now subscription aggregators, controlling the customer relationship, billing, and data.

- Subscription Services That Embrace Indirect Channels – Those who integrate into bundles will gain scale, lower churn, and lower acquisition costs.

- Super Bundling Platforms – Services that consolidate subscriptions into a single hub will dominate the next phase of digital media.

Losers:

- Pure DTC Holdouts – Services that still insist on only selling direct will lose market share as consumers opt for convenience.

- Platforms That Don’t Offer Flexible Subscription Models – Consumers want choice, customization, and control—rigid subscription structures will struggle to compete.

The Subscription Economy Isn’t Dying—It’s Just Changing. Services that adapt to the bundle economy will thrive. Those that don’t? They’ll struggle to remain relevant.

Final Thoughts: The Subscription Model Has Evolved

The direct-to-consumer dream hasn’t disappeared—but it has fundamentally changed. Consumers don’t want to manage 10+ standalone subscriptions—they want simplicity, flexibility, and value. And that means bundles, aggregation, and centralized control are the future.

For subscription businesses, the question is no longer “Should we bundle?” but “How do we bundle effectively?”

- Streaming services, gaming platforms, and digital subscription businesses need to embrace this shift—or risk being left behind.

- The battle for subscribers is no longer about who can win them over directly. It’s about who can integrate into the most valuable bundle.

Bango’s research confirms it: The bundle economy isn’t coming—it’s already here. The real challenge now is how subscription services position themselves within it.

Read the full Bango 2025 “Subscriptions Assemble” Report here: Bango 2025 Subscriptions Assemble Report.