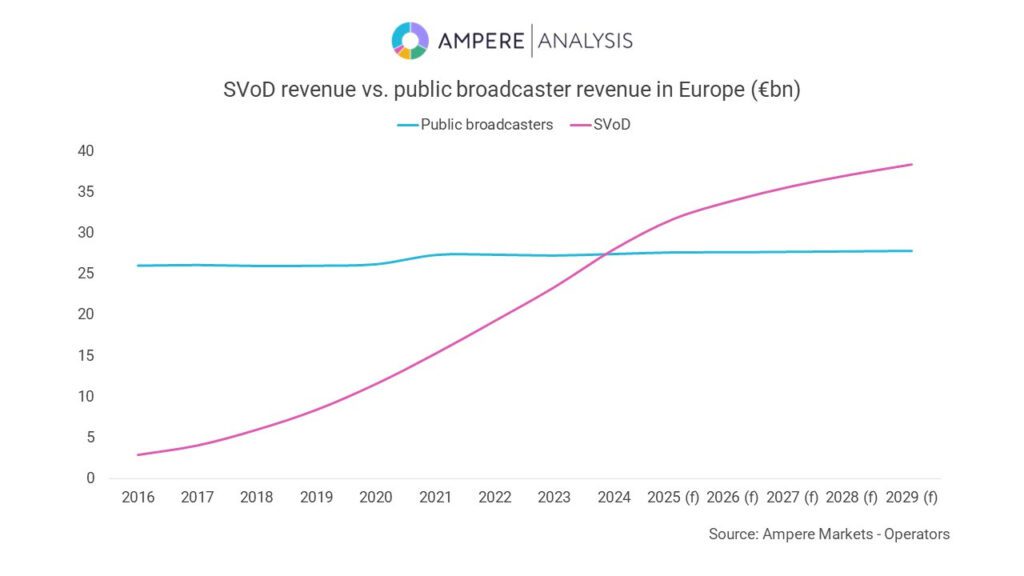

For the first time, streaming revenue in Europe has surpassed public service broadcasting (PSB) revenue, marking a major shift in the financial landscape of the region’s TV industry. According to new research from Ampere Analysis, revenues from paid streaming services—including both subscriptions and advertising—overtook public TV revenues in 2024. With streaming revenue projected to grow by 37% to reach €38.4 billion ($40.3 billion) by 2029, compared to a mere 1% increase in public TV revenue (to €27.9 billion / $29.3 billion), the future of European public broadcasting is under pressure.

This change raises critical questions about how PSBs should adapt to remain competitive in an industry increasingly dominated by US streaming giants. The challenge is twofold: how can they secure sustainable funding, and how can they continue producing high-quality content while maintaining their core public service mission?

Streaming’s Rapid Growth – and Public TV’s Struggles

Streaming’s dominance in Europe has been fueled by a mix of factors, including the rise of ad-supported streaming models, price hikes in subscription services, and the expansion of US-based platforms like Netflix, Disney+, and Amazon Prime Video.

Key Drivers of Streaming Growth:

- Netflix’s market leadership: The company has driven significant revenue growth since introducing its ad-supported tier in 2022 and cracking down on account sharing. It has also expanded into live events, creating new monetization opportunities.

- The rise of ad-supported streaming: Disney+ and Amazon launched ad-supported plans in Europe, and by 2029, advertising is expected to contribute 8% of US streamers’ total European revenues.

- Subscription price increases: Most major streamers have raised prices, further boosting revenue.

- Expansion of services: Platforms like Max (formerly HBO Max) continue to launch in new European markets, increasing competition.

Meanwhile, public TV revenue has largely stagnated, with funding models under strain. Many European countries have historically relied on license fees and public taxes to finance PSBs, but this model is under increasing scrutiny. France, for instance, recently abolished its license fee, forcing its public broadcasters to seek alternative funding sources.

Public Broadcasters’ Role as a Stabilizing Force

Despite these financial pressures, European public service broadcasters still play a vital role in content production and local storytelling. In 2024, PSBs commissioned 43% of all TV titles in Europe, demonstrating their importance in sustaining the region’s production sector. However, if their financial power declines further, it could have significant implications for the future of European television.

At the same time, PSBs have remained highly relevant in the streaming era, with their video-on-demand (VoD) services ranking among the most used platforms in many European countries. Ampere’s research found that in Q3 2024, local public broadcaster VoD services were the second most-used streaming platforms in the UK, Denmark, and Finland and the third most-used in Sweden and Norway.

This strong engagement highlights the enduring appeal of public broadcasters’ content—particularly in providing local, culturally relevant programming that global streamers often overlook.

The Future of Public Service Broadcasting in Europe

With streaming services rapidly outpacing traditional public TV in revenue, European public broadcasters must rethink their strategies. According to Ampere’s analyst Sam Young, the key to survival will be adapting to the digital era while navigating uncertain financial structures.

Potential Strategies for Public Broadcasters:

Strengthening Streaming Offerings

PSBs need to invest in their own digital platforms, ensuring they remain competitive in an increasingly VoD-driven landscape. High-quality, on-demand content with strong national and regional appeal will be crucial.Strategic Partnerships

Collaborations with other broadcasters, production companies, and even global streaming platforms could help lower content costs and expand distribution reach.Innovative Funding Models

Governments must reconsider how PSBs are funded. Whether through new tax-based models, hybrid funding mechanisms, or increased commercial opportunities, a sustainable financial framework is critical.Leveraging Local Content Strengths

While global streamers prioritize big-budget productions with mass-market appeal, PSBs should double down on unique, locally focused storytelling—one of their biggest competitive advantages.Expanding Advertising and Monetization Options

As global streaming giants lean more heavily on ad-supported tiers, PSBs could also explore advertising-supported VoD (AVoD) models, ensuring their platforms generate additional revenue without compromising public service commitments.

The Take

The transition from public broadcasting dominance to a streaming-led industry isn’t just about revenue shifts—it’s about control over the future of European storytelling. If PSBs lose financial ground, they risk losing influence over content creation, which could lead to less diversity in programming and a heavier reliance on global media conglomerates.

While streaming’s rise is inevitable, the importance of locally funded, culturally relevant public broadcasting cannot be overstated. If European governments want to maintain a robust, independent media ecosystem, they must act now to ensure PSBs remain viable in the streaming era.

Final Thought

The next few years will be pivotal for European public service broadcasters. Those that embrace digital transformation, form smart partnerships, and push for sustainable funding solutions will have a fighting chance. Those that fail to adapt may find themselves sidelined in a streaming-dominated landscape.