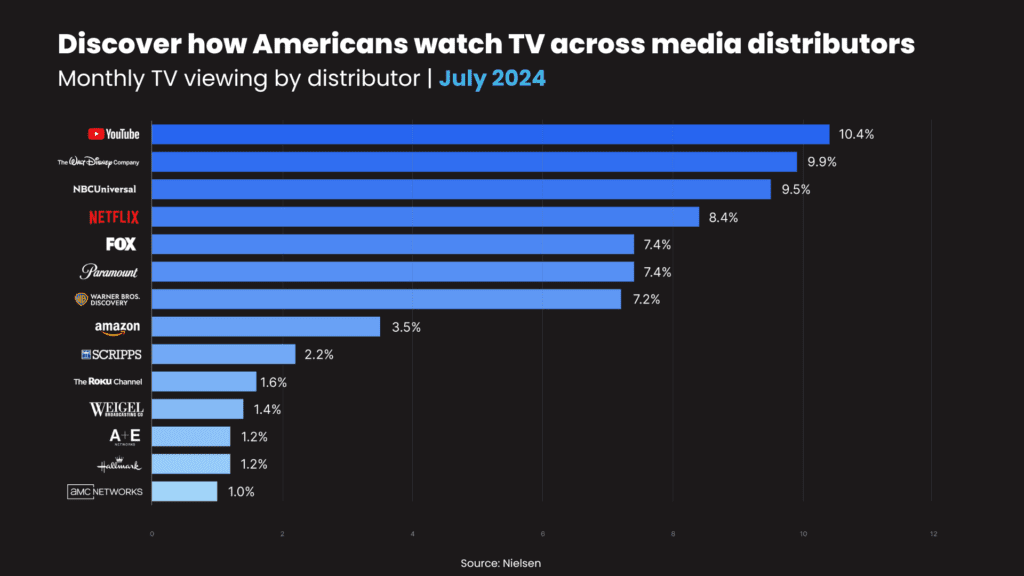

According to Nielsen’s Media Distributor Gauge, YouTube officially overtook Disney as the most-watched media company in the U.S. in July 2024, accounting for 10.4% of total TV viewing. This marks the first time a streaming platform has exceeded 10% of TV viewership in a single month, with Disney following at 9.9%.

The jump in YouTube’s viewership was driven primarily by school-aged viewers (ages 2-17) on summer break, who accounted for nearly 30% of the platform’s total TV viewing. The surge in young audiences helped propel YouTube to this milestone, overtaking Disney’s previous dominance and underscoring the growing shift toward streaming platforms for entertainment.

How YouTube Became TV’s New Powerhouse

YouTube’s rise to dominance wasn’t just about capturing views—it’s about sheer scale. As of 2024, YouTube has over 2.5 billion monthly active users, making it the second most-used social media platform globally, right behind Facebook. Its influence stretches beyond social media, though: in the media world, YouTube’s estimated value of $400 billion far exceeds even legacy media giants. For comparison, Netflix ($289.8 billion), Paramount ($7.4 billion), Warner Bros. Discovery ($18 billion), and Fox ($18.2 billion) together total around $333 billion—still falling short of YouTube’s standalone value. This scale and its dominance in user-generated content and professional media solidifies YouTube’s place as a TV powerhouse.

A Magnet for Advertisers

YouTube’s appeal to advertisers is tied to its massive audience and unrivaled ability to target specific viewers across different platforms. This has made YouTube an advertising juggernaut. In the first quarter of 2024 alone, YouTube pulled in $8.1 billion in ad revenue—a 20% increase over the previous year. Analyst Michael Nathanson projects that YouTube generated $45 billion in total revenue for 2023, underscoring its pivotal role in Google’s overall business.

While other media companies diversify their revenue streams—through theme parks, broadband services, or traditional TV networks—YouTube remains focused on video, advertising, and subscriptions. This focus is one of the reasons behind its estimated $400 billion valuation. Advertisers are drawn to the platform’s ability to engage diverse audiences, from mobile users to those watching on connected TVs, making it essential for brands of all sizes.

Competing with Traditional Media

YouTube’s rise to TV dominance has forced traditional media companies like Disney, Netflix, and NBCUniversal to adapt. Disney, which had led the Nielsen rankings for much of 2024, saw its share of TV viewing slip to 9.9% in July. NBCUniversal, benefiting from the Summer Olympics and the Republican National Convention, increased its viewership to 9.5%. Despite these shifts, YouTube’s ability to attract younger viewers, especially those aged 2-17, has set it apart from its competitors.

Platforms like Netflix, which focuses heavily on premium, long-form content, and legacy media companies are finding it increasingly difficult to compete with YouTube’s broad range of content that caters to nearly every taste and interest. With Gen Z and younger Millennials now viewing YouTube as their primary entertainment source, the platform has become a critical part of the future TV landscape.

Is YouTube Profitable?

Although YouTube is valued at over $400 billion, questions about its profitability remain. As part of Google, YouTube’s financial details are tightly controlled, making it unclear how much profit the platform generates. What is clear, however, is that YouTube has become a significant revenue driver for Google. In the last three years, YouTube has paid out $70 billion to creators through its Partner Program, which gives creators 55% of ad revenue for long-form videos and 45% for YouTube Shorts.

The platform’s ability to draw advertisers and creators has made it a critical part of Google’s business model, even if the exact profit margins remain unknown.

What YouTube’s Rise Means for TV

YouTube’s dominance in July 2024 clearly shows how TV consumption is shifting. Streaming platforms like YouTube are not just alternatives to traditional TV—they’re becoming the primary way audiences, particularly younger ones, consume content. For legacy media companies, this means rethinking how they distribute content and engage audiences, particularly on platforms they don’t control.

Meanwhile, YouTube’s position as a leading media company isn’t without its challenges. The platform faces ongoing scrutiny over content moderation, privacy concerns, and competition from other streaming services. As more traditional TV networks launch ad-supported tiers, YouTube will face increasing competition for viewership and ad dollars. However, with its broad appeal and continuous innovation, YouTube is well-positioned to remain a key player in the evolving TV landscape.