This is the second part of a two-part series. You can read Part 1 Why Old Shows Are New Again on Netflix: What it Means for Content Owners here.

As the streaming landscape becomes increasingly crowded, media companies face a critical decision: Where should I distribute my content? Netflix’s meteoric rise has triggered fierce competition, with traditional players like Disney+, HBO Max, and Amazon investing billions to compete. The streaming “content arms race” has intensified, with companies spending enormous sums to capture viewer attention. In this evolving environment, media companies must determine whether to license their content to third-party platforms like Netflix or keep it exclusive to their proprietary streaming services.

The balance between immediate revenue and long-term strategy is at the heart of this dilemma. While Netflix offers unparalleled global reach, exclusive content is often a key driver of subscriptions to in-house platforms. This section will explore the pros and cons of licensing content to third-party platforms and the trade-offs media companies must consider.

Licensing Content to Third-party Platforms

In today’s fiercely competitive streaming landscape, media companies face the critical decision of licensing their content to platforms like Netflix or keeping it exclusive to their proprietary services. Licensing offers significant advantages in terms of exposure and financial gain but comes with trade-offs that can impact long-term business objectives.

The Pros:

1. Access to a Vast, Global Audience

Platforms like Netflix, with 278 million subscribers, provide media companies access to an immense global audience. Licensing content can revive older shows, as seen with Prison Break and Suits, exposing them to new viewers and re-establishing cultural relevance.

2. Immediate Revenue from Licensing Deals

Licensing content offers immediate cash flow without the operational costs of maintaining a streaming platform. Licensing deals between media companies and platforms like Netflix and Disney+ can vary significantly in structure and value, depending on the content involved, geographic exclusivity, and duration. Here are a few notable examples:

Sony’s Licensing of Spider-Man and Other Films

In 2021, Sony struck a multi-year deal with Disney, allowing Spider-Man and other Sony films to be streamed on Disney+ and Hulu after their run on Netflix. This deal, valued at $3 billion, covered Sony’s films from 2022 to 2026. It allowed Disney to add high-demand content like Spider-Man to its catalog while providing Sony significant revenue without the burden of maintaining its platform.

Warner Bros. Discovery Boosts Revenue with Licensing Deals in Q2 2023

In the second quarter of 2023, Warner Bros. Discovery reported $2.73 billion in direct-to-consumer (DTC) revenue, with content licensing playing a pivotal role. Licensing HBO shows like Westworld to services like Freevee and the Roku Channel and Insecure to Netflix contributed $410 million in licensing revenue, tripling the previous year’s figure. This surge helped narrow the company’s losses, positioning its U.S. streaming business for potential profitability by the end of 2023.

3. Increased Brand and Content Visibility

The “Netflix Effect” can significantly boost brand visibility. By licensing to Netflix, dormant shows can experience a resurgence in popularity, which may lead to increased interest in the media company’s broader catalog. This effect can keep legacy content culturally relevant and create opportunities for monetization through merchandise, spin-offs, or sequels.

The Cons:

1. Potential Cannibalization of Proprietary Streaming Services

Licensing high-quality content to platforms like Netflix may reduce the appeal of proprietary streaming services. For companies like Disney and Max, keeping marquee content exclusive is key to attracting and retaining subscribers. Licensing top-tier content risks making Netflix the preferred platform for viewers seeking their shows.

2. Loss of Exclusive Content Draw for In-house Platforms

Exclusive content often serves as a critical draw for subscribers. If media companies license their most popular shows to third-party platforms, they may undermine the unique value proposition of their in-house services. Without exclusive content, proprietary platforms can struggle to differentiate themselves in the crowded streaming market.

3. Reduced Control Over Audience Data and Engagement

When licensing content to Netflix, media companies lose the ability to collect data and gain insights into viewer behavior. Netflix controls the data and audience engagement metrics, making it difficult for content creators to understand their audiences or optimize content offerings based on real-time feedback.

The Hybrid Approach: Combining Exclusive and Licensed Content

A hybrid distribution model can offer the best of both worlds by windowing content, keeping it exclusive for a period before licensing it to platforms like Netflix. Thus, media companies can retain the advantages of exclusivity while also benefiting from the wider reach and visibility of third-party platforms.

Short-term Exclusivity

Media companies can retain high-value, in-demand content exclusively on their own streaming platforms for a limited period. This approach drives initial subscriptions, viewer engagement, and platform loyalty. For instance, keeping a popular series exclusive for the first few months encourages viewers to subscribe and stay engaged. After this exclusive window ends, companies can license the content to larger platforms like Netflix or broadcast services, thereby expanding its audience reach while maintaining core subscriber interest.

Windowing to Netflix or Other Platforms

Once the exclusive window has expired, licensing content to major platforms like Netflix or other non-competing services offers a second wave of revenue. This strategy leverages Netflix’s massive audience—particularly when it comes to legacy content or series that can gain renewed popularity through the “Netflix Effect.” Shows like Prison Break and Suits have seen surges in viewership after being licensed to Netflix.

Netflix’s diminishing U.S. content library, shrinking from 11,000 titles in 2015 to around 6,000, also makes licensed content valuable, as it helps Netflix maintain variety and relevance amid intensifying competition.

Additionally, licensing older or short-lived series to FAST services like Roku, Freevee, and Crackle can breathe new life into undervalued content. These platforms offer media companies new revenue streams for content that may have completed its run on major platforms, providing additional value without the costs associated with original production.

Case-by-case Evaluation

Not all content should follow the same distribution strategy. Companies need to evaluate their content portfolios case-by-case, considering factors like genre, target audience, and market potential. For instance, popular genres like drama, animation, and comedy, especially crime dramas, Japanese animation, and sitcoms, typically benefit from broader licensing to platforms like Netflix or international broadcasters. These genres have wide appeal, making them ideal for increased visibility and monetization across regions.

In contrast, certain niche content, such as specific Japanese animation, may perform better as long-term exclusives on proprietary platforms. Keeping these shows exclusive helps maintain platform value, drive subscriber retention, and differentiate the service from competitors.

Ultimately, licensing or keeping content exclusive should align with the company’s broader goals, whether it involves maximizing reach and revenue through licensing or driving subscriber growth and retention through exclusivity.

International Partnerships

In addition to windowing and licensing, media companies can explore international partnerships to expand content distribution. For instance, Netflix partnered with platforms like SkyShowtime and other European broadcasters to license shows like Ozark and Narcos. These partnerships provide valuable revenue streams and broaden Netflix’s global audience while still preserving the company’s core U.S. market. This strategy helps media companies maximize international reach without compromising their primary offerings.

By adopting this hybrid distribution model, media companies can maintain control over their most valuable content, enhance visibility through broader licensing, and generate revenue in both domestic and international markets.

So, where does YouTube fit in with Regard to my Content Distribution Strategy?

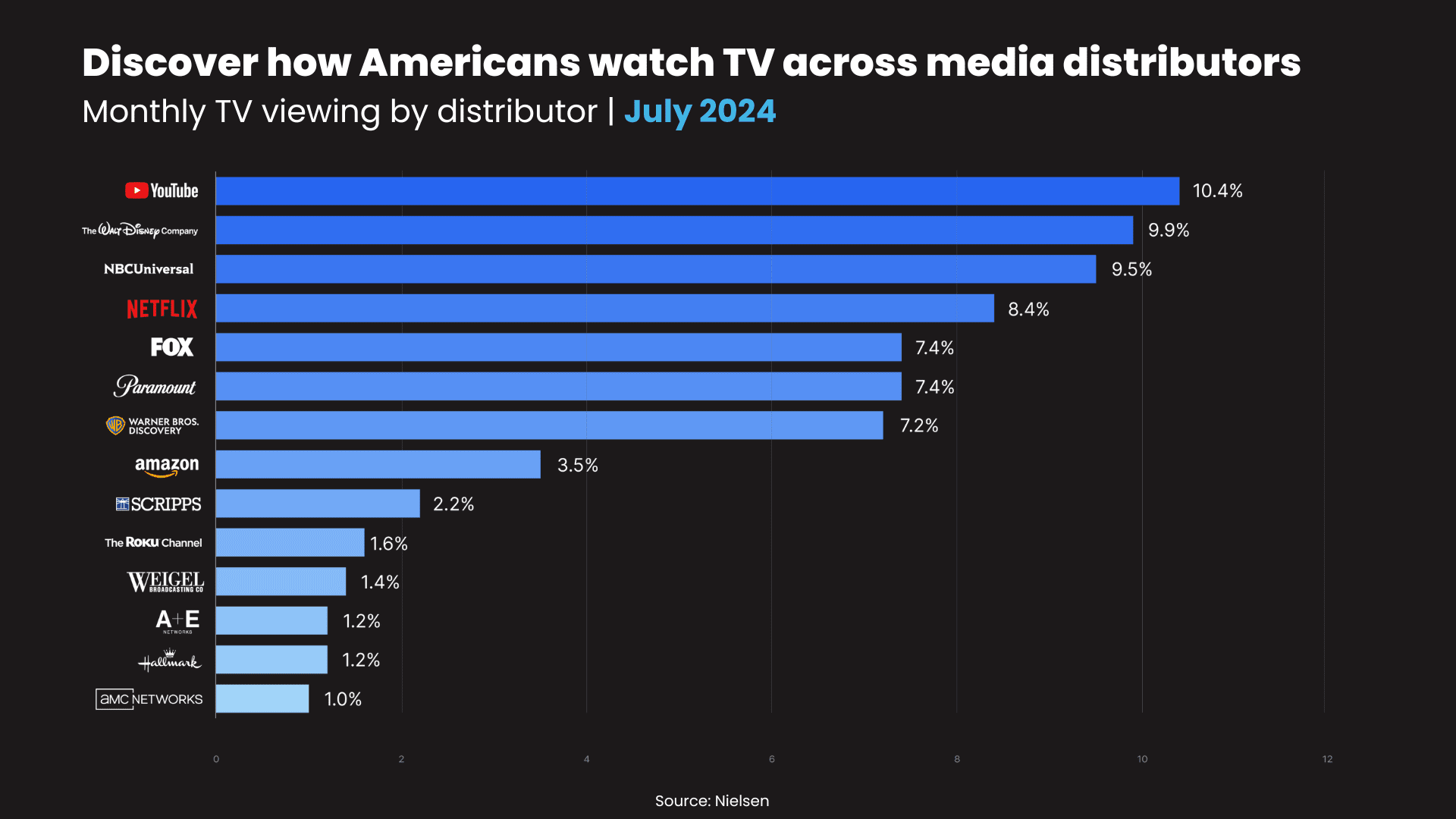

As YouTube surpasses Disney as the most-watched media platform, media companies can no longer ignore its power in their distribution strategies. YouTube provides a unique opportunity for content creators to engage with audiences, drive awareness, and generate revenue outside of traditional streaming models.

Beyond a Barker Channel

While many companies still use YouTube primarily as a promotional tool (a “barker channel”) to showcase trailers and clips, YouTube’s rise as the most popular streaming service on U.S. televisions highlights its potential for original content creation. Beyond just promoting premium content, media companies can create exclusive content tailored to YouTube, such as behind-the-scenes footage, interviews, or web-only series. This approach helps build deeper connections with fans, engage younger demographics, and foster greater brand loyalty.

YouTube once attempted to compete directly with Hollywood, but it shifted focus two years ago and leaned into user-generated content. This move, seen as a concession at the time, allowed YouTube to grow into the most popular streaming platform. Today, YouTube consistently tops TV streaming charts, proving that platforms don’t need to follow the billion-dollar investment strategies of Netflix and Disney to succeed.

Monetization and Engagement

YouTube offers several robust monetization options to help media companies diversify their revenue streams. These include ads, sponsorships, and premium content subscriptions. In the second quarter of 2024, YouTube generated $8.66 billion in ad revenue, underlining its potential as a significant revenue driver for content creators. Moreover, the platform paid creators $70 billion over the last three years, based on a revenue-sharing model where creators earn a percentage of the ad revenue generated by their content.

This model helps creators succeed and allows YouTube to thrive without the financial risks associated with producing expensive original content. By leaving creative decisions and production costs to its users, YouTube can share in the profits of successful content without shouldering the burden of failure.

For media companies, YouTube offers an opportunity to develop both promotional and monetizable content that doesn’t require significant upfront investment. By maintaining a strong presence on YouTube, companies can use the platform to drive awareness of their premium offerings on other platforms while generating additional revenue.

Audience Insights

One of YouTube’s greatest strengths is its ability to provide detailed audience engagement data. The platform offers insights into metrics such as views, likes, comments, and watch time, all of which can help media companies refine their content strategies. This level of data allows companies to understand viewer preferences better and tailor their content to match audience demands.

Moreover, YouTube has a broad demographic reach, attracting a diverse audience. In May 2023, 48% of YouTube’s TV viewership came from people under 34, while the platform also performed well among Black, Asian, Hispanic, and Spanish-speaking households. With its wide appeal, YouTube offers something for every demographic, making it a key tool for media companies looking to engage a broad and diverse audience.

YouTube’s Hands-off, Creator-Led Model

YouTube’s rise to the top of the streaming leaderboard is largely due to its hands-off approach to content creation. Unlike platforms like Netflix, which spend billions on original series and films, YouTube allows its creators to decide what content they produce. This approach minimizes risk for YouTube, as it shares revenue with creators only after content becomes successful.

Neal Mohan, YouTube’s CEO, noted that YouTube’s success comes from the creativity of its users. “Our creators are much better at predicting what our fans and audiences want,” he said, underscoring the platform’s strategy of letting creators dictate the content landscape. In this way, YouTube has remade television for a new generation, shifting away from the traditional studio-driven approach to one where everyday users can create content that resonates.

Now, YouTube draws 150 million viewers in the U.S. watching content on televisions, with popular creators like Mr. Beast, music videos, and even TikTok-style Shorts dominating the platform. For 17 months, YouTube has topped the list of streaming time on TV, capturing 9.9% of the market in June 2023, more than any other streaming service.

Crafting the Right Strategy

There is no one-size-fits-all solution when it comes to content distribution. Media companies must weigh the benefits of licensing their content to platforms like Netflix against the advantages of maintaining exclusivity on their own streaming services. Each decision must account for factors such as revenue potential, audience reach, and long-term brand strategy.

The resurgence of older shows like Prison Break and Suits on Netflix highlights the power of legacy content and the potential rewards of a well-executed licensing strategy. Licensing legacy content to platforms like Netflix provides immediate visibility and the chance to reach new audiences, as seen with the surge in viewership for Prison Break. However, media companies must also consider the potential risks. Cannibalization of their own platforms and loss of control over audience engagement and data can undermine proprietary services. A flexible, hybrid approach that balances exclusivity with strategic licensing may offer the best path forward, allowing companies to maximize both reach and engagement without undermining their platforms.

Incorporating platforms like YouTube into the overall content strategy can further enhance visibility and provide additional opportunities for monetization and audience interaction. Netflix, for example, has taken this approach to a new level by leveraging YouTube, which might initially seem like a competitor, to expand its reach. A recent bold move was Netflix uploading the full Oscar-nominated film Nimona to YouTube, where it garnered 2 million views in just four days.

This tactic demonstrates the power of using YouTube’s massive user base to boost visibility and attract a new audience. By offering full-length, high-value content rather than just trailers or promotional clips, Netflix strategically positions itself to capture traffic and redirect it back to its main platform. This approach amplifies content exposure and signals a shift in how long-form content can be marketed, transforming the way media companies balance streaming exclusivity with broader platform reach.

Ultimately, the key to success in the streaming landscape is adaptability. Media companies that can pivot and refine their strategies based on evolving viewer behavior and industry trends will be best positioned to thrive in the competitive streaming market.

Summary of Key Lessons from Legacy Content and Modern Distribution Strategies

In the previous article, we explored the growing trend of legacy content finding new life on platforms like Netflix. The resurgence of older shows like Prison Break and Suits demonstrated the strength of Netflix’s reach and recommendation algorithms, which bring older content back into the spotlight. Shows like Prison Break garnered 1.6 billion minutes of viewership within a week of its return to Netflix, highlighting the immense potential of licensing content to popular streaming platforms. The so-called “Netflix Effect” revives older shows and helps platforms build engagement through tried-and-true content that may have otherwise faded from relevance.

Furthermore, we examined how the historical relationship between networks and Netflix has evolved. AMC Networks, for example, continues to use Netflix as a platform to boost the visibility of its content. Deals like the recent agreement to bring 13 series to Netflix showcase how partnering with third-party platforms can drive viewership for both the streaming service and the content owner.

We discussed the importance of crafting a balanced distribution strategy in this. The decision to license or keep content exclusive must account for the company’s specific goals, whether that be increasing reach, maximizing revenue, or maintaining control over audience data. While licensing can offer immediate financial returns and visibility, there are risks of losing long-term value for proprietary platforms. Platforms like YouTube further complicate the strategy by offering another content creation and monetization channel.

Actionable Advice for Media Companies

1. Embrace Flexibility with a Hybrid Approach

Media companies should avoid committing exclusively to one distribution strategy. Instead, they should adopt a flexible hybrid model that leverages licensing’ strengths while keeping key content exclusive to their platforms to drive subscriptions. Windowing strategies, where content is kept exclusive for a time before being licensed out, allow for greater control over audience engagement and churn.

2. Focus on Audience Data and Engagement

Maintaining control over user data is crucial in shaping future content strategies. Media companies should prioritize platforms where they can gather insights into user behavior through their own services or by negotiating favorable terms when licensing to third parties.

3. Leverage YouTube for Supplementary Content

Using platforms like YouTube for supplementary content—such as behind-the-scenes footage, interviews, or web-only series—can be a powerful way to keep audiences engaged between major content releases. YouTube’s ad and subscription revenue models also provide additional monetization opportunities.

4. Adapt to Viewer Behavior Trends

The success of legacy content shows that older, well-told stories still resonate with audiences today. Media companies should continue exploring ways to bring classic content to new viewers while investing in high-quality original programming that stands the test of time.

By balancing these approaches, media companies can capitalize on short-term gains and long-term audience loyalty in the ever-changing streaming landscape.