As consumer frustrations with rising subscription costs and fragmented content availability intensify, unlicensed streaming devices like Superbox and Prime Stream are tapping into a demand that legitimate services increasingly struggle to meet. Providing access to premium TV shows, niche channels, and live events, unlicensed streaming devices exploit a legal gray area, sidestepping the limitations of traditional licensed platforms. This rise signals more than a piracy problem for media execs—it’s a wake-up call to rethink content distribution and pricing models in a subscription-fatigued market.

Understanding Superbox and Prime Stream

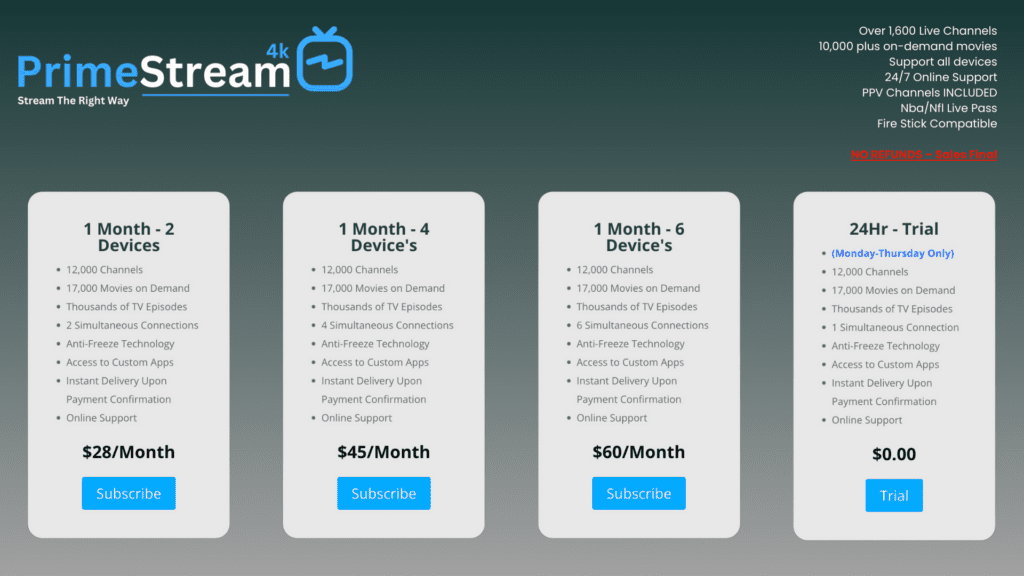

Unlicensed streaming devices like Superbox and Prime Stream cater to consumers’ desire for an all-in-one solution that bypasses the need for multiple subscriptions. These devices, often Android-based, exploit the flexibility of Android TV boxes, enabling users to install third-party applications that aggregate both legitimate and pirated content.

Superbox, in particular, is essentially an Android TV box with a custom user interface and a few pre-installed streaming apps. For instance, it comes with a pre-installed app called BlueTVLive, which offers an extensive lineup of channels streaming popular shows around the clock. Some channels, like those dedicated exclusively to Scooby-Doo or Growing Pains, provide continuous streams of series that users won’t find on licensed FAST services (as far as we know), by providing niche and nostalgic content unavailable on traditional services, devices like Superbox fill a gap in the market, further attracting consumers frustrated with rising subscription costs and fragmented content ecosystems.

A New Chapter in the Subscription Economy’s Piracy Battle

According to a recent Bango study of 5,000 U.S. subscribers, nearly 28% of respondents reported viewing piracy as the only way to access all their desired content in one place. In Europe, 19% of consumers admit using pirate streaming services as a workaround to fragmented content, especially for TV shows. With nearly a quarter of viewers turning to unlicensed devices, the message is clear: the current content ecosystem is pushing audiences toward gray-market solutions.

The Gray Market: From Zediva and Aereo to Superbox

The rise of unlicensed streaming devices like Superbox and Prime Stream echoes the industry disruptions caused by Zediva and Aereo over a decade ago. Both Zediva and Aereo gained attention by exploiting legal loopholes to offer low-cost, widely accessible content without paying traditional licensing fees. Zediva attempted to bypass distribution restrictions by streaming movies from physical DVDs housed in data centers, while Aereo relied on micro-antennas to stream live broadcasts for individual users. Although both companies eventually lost in court, their innovative approaches highlighted consumer demand for affordable, flexible access—a demand that unlicensed devices today continue to meet.

Why Consumers Choose Unlicensed Devices: The All-in-One Solution

The primary appeal of unlicensed devices lies in simplicity and affordability. Consumers, frustrated with the need for multiple subscriptions to access desired content, are increasingly attracted to devices like Superbox, which bundle content in a single interface without recurring fees. For many users, these devices offer a welcome alternative to juggling multiple paid subscriptions.

The Deloitte Digital Media Trends report reveals that U.S. households now average four streaming subscriptions, with 25% of consumers admitting to either sharing passwords or watching pirated content in the last year. Younger viewers, especially Gen Z and Millennials, drive much of this behavior, thanks to their familiarity with technology and limited disposable incomes.

The Psychology of Video Piracy: A Spectrum of Motivations

To combat piracy, it’s crucial to understand what drives users to unauthorized platforms. Research shows that piracy behaviors span a spectrum from password sharing, a “normative” crime many consumers see as harmless, to sophisticated crime syndicates creating counterfeit streaming services. Between these extremes lie a range of behaviors, from using VPNs to bypass geo-restrictions to accessing pirated content through unlicensed devices.

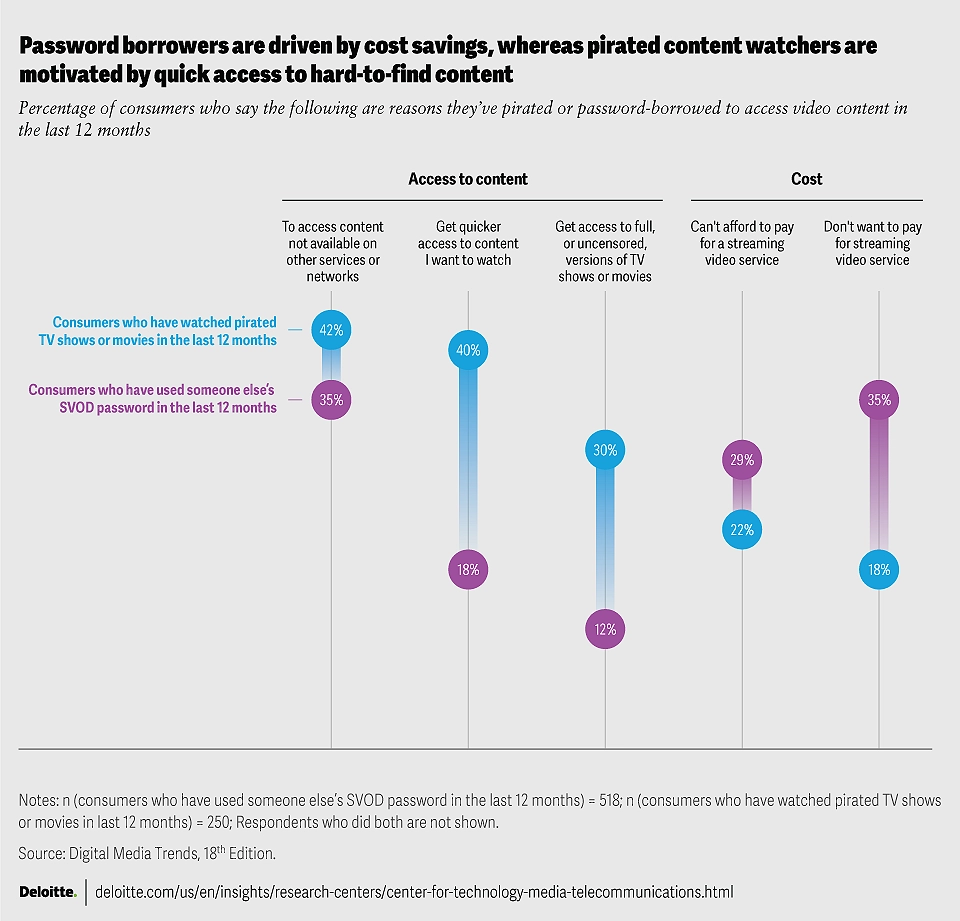

According to Deloitte, the motivations behind video piracy diverge based on user type:

Password Borrowers

Driven by cost savings, 15% of respondents share streaming service credentials to manage rising subscription costs. Among these users, 73% express frustration with rising prices, and 53% report canceling at least one paid service in the past six months. Financial considerations make this group especially likely to adopt unlicensed devices if prices continue to rise.

Pirated Content Watchers

This group seeks quick, unrestricted access to premium content. Forty percent of pirated content watchers cite immediacy as a primary motivator, while half report that the value of streaming subscriptions simply doesn’t justify the cost. With higher-than-average churn rates, these users gravitate toward unlicensed devices that deliver niche or region-locked content without delay.

Understanding these motivations reveals that both cost-conscious viewers and those dissatisfied with content accessibility are pushing back against traditional subscription models. If legitimate platforms continue to fragment content and raise prices, they risk losing these users permanently.

The Financial Toll: Piracy’s Impact on the Industry

The financial impact of piracy is staggering, with annual U.S. revenue losses estimated between $29.2 billion and $71 billion. Globally, piracy accounts for an additional $40 billion to $97.1 billion in lost revenue, with unlicensed streaming devices siphoning off paying customers who might otherwise subscribe to legal services. Deloitte’s data reveals that both password borrowers and pirated content watchers consume substantial amounts of content on free, ad-supported streaming (FAST) services, underscoring how these users would still engage with legitimate platforms—if the right incentives were in place.

Addressing the Piracy Surge: Strategies for Retaining Audiences

For the media industry, tackling piracy effectively requires more than just enforcement. As Superbox and other unlicensed devices continue, media companies need a multi-faceted response that balances anti-piracy measures with audience-focused solutions.

- Affordable, Flexible Pricing Models

Addressing subscription fatigue means exploring more flexible, budget-friendly options. Offering pay-per-view pricing for high-demand events, low-cost tiers, and expanded FAST channel offerings can attract users who are unwilling or unable to maintain multiple subscriptions. According to Deloitte, FAST channels have particular appeal to both password borrowers and pirated content watchers, making them a valuable tool for keeping price-sensitive viewers within licensed ecosystems. - Educational Campaigns on the Risks of Piracy

Highlighting the risks of piracy, including malware threats and data breaches, can help deter consumers from choosing unlicensed devices. Similar to anti-piracy efforts in the music industry, public education campaigns could increase awareness of the value of legitimate services. The industry’s success in curbing music piracy demonstrates the potential effectiveness of educating consumers about the downsides of gray-market devices. - Holistic Anti-Piracy Partnerships

Following Netflix’s success with password-sharing crackdowns, streaming providers should consider partnerships with security experts to strengthen anti-piracy measures. Investing in AI-driven content protection and blockchain-based tracking could prevent unauthorized access and protect licensed content. For consumers, a commitment to securing their viewing experience enhances brand trust, potentially reducing piracy appeal. - Increasing Niche Content Through FAST Integration

Offering niche and international content on licensed platforms could capture the audiences currently turning to unlicensed devices for exclusive or hard-to-find programming. By increasing the availability of niche FAST channels, streaming services can reduce the demand for pirated options and appeal to specialized audiences, pulling more users back into legitimate ecosystems.

The Path Forward

The rise of unlicensed streaming devices underscores potential weaknesses in the video subscription model. For media esexs, this is a critical moment to reassess content strategies and find innovative solutions that meet evolving consumer expectations. Failure to adapt to consumer demand could mean further revenue losses and a long-term decline in viewer loyalty.

If the industry can address the root causes of piracy—high costs, limited access, and content fragmentation—it stands a better chance of turning these challenges into opportunities. Media companies can protect revenue streams and regain control of content distribution by adopting a consumer-focused strategy that includes competitive pricing, anti-piracy education, and niche content expansion. The stakes are high, but with strategic adjustments, legitimate streaming can remain the preferred choice in the digital entertainment landscape.