Fubo has taken a significant step in its evolution by launching a standalone premium subscription service, officially entering the growing “Channels” business. This new offering allows customers to subscribe to services like NBA League Pass, Paramount+ with Showtime, and FanDuel Sports Network without needing to sign up for Fubo’s core virtual MVPD (vMVPD) plan. This move positions Fubo as a reseller of streaming subscriptions, marking a shift toward a more flexible, super-aggregator model.

This development fits within a larger strategy of offering customers access to premium content without being tied to expensive live TV packages. With this, Fubo continues to strengthen its presence as a one-stop platform for a mix of live and on-demand content, catering to the increasing demand for customized streaming bundles.

A Smart Play for Growth

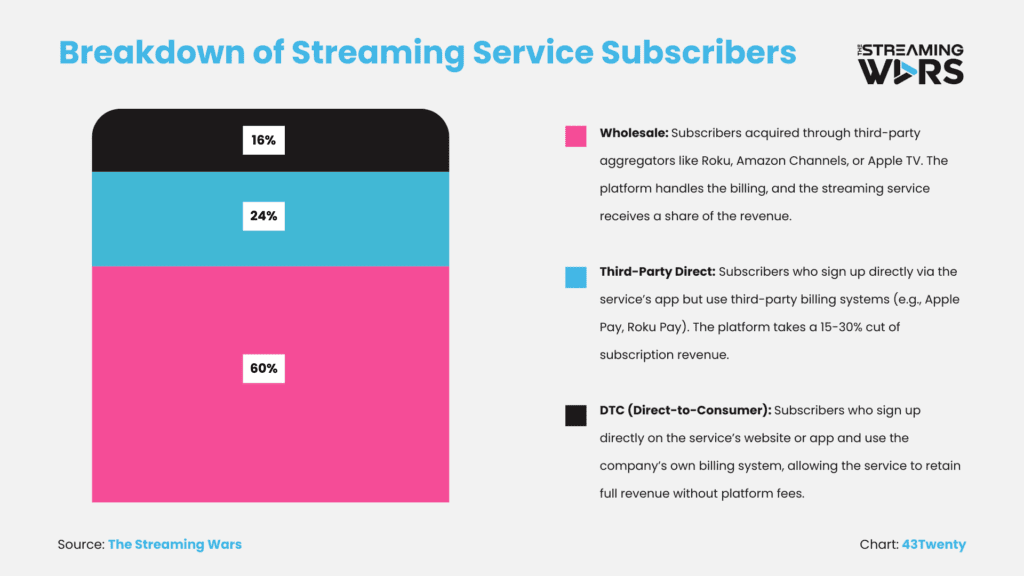

Fubo’s move into the Channels business comes at a critical time. Margins on core live TV packages are razor-thin, typically around 2-3%, making premium add-ons essential for boosting profitability. Our recent research shows that 60% of streaming subscriptions are sold through bundles, and consumers are more likely to opt for multiple services when they can manage them through a single bill. By offering these standalone services, Fubo caters to users who prefer this convenience and partners with services that haven’t fully committed to direct-to-consumer (DTC) strategies.

What’s more, offering these premium add-ons is a smart anti-churn strategy. For seasonal churners—those who leave once sports seasons are over—access to Fubo’s 200+ FAST channels and third-party services like Paramount+ means they’re more likely to stay engaged in the ecosystem. This generates ARPU (average revenue per user) for Fubo even during off-seasons.

Additionally, this approach helps close the gap in quarterly earnings reports. Even if a user downgrades to Fubo Free but continues to subscribe to Paramount+ or another premium service, Fubo can still count them as an active subscriber. This is crucial for maintaining subscriber counts and keeping Wall Street confident in Fubo’s growth trajectory.

Inside the Revenue Model

Inside the Revenue Model: Fubo’s Deal with Premium Partners

According to our sources, Fubo has negotiated revenue shares ranging between 5-20%, depending on the partner. For instance, we speculate that FanDuel Sports Network could deliver a 10-15% revenue share to Fubo. Meanwhile, NBA League Pass might offer an even higher 10-20% share, primarily because sports leagues like the NBA aren’t producing most of the content themselves. Instead, they’re retransmitting existing linear RSN feeds, reducing operational costs and allowing for a more favorable revenue split for Fubo.

In contrast, Paramount+ with Showtime, with its stronger market position, likely commands a smaller 5-10% revenue share. Paramount has greater negotiating leverage due to its established presence and strong bargaining power, enabling it to secure tighter margins in these deals.

By securing revenue shares in this range, Fubo is positioning itself to earn significantly from these premium services without the heavy burden of content production costs.

Fubo’s Future: Retaining Viewers and Boosting Margins

Fubo’s blend of free ad-supported content, premium add-ons, and standalone subscriptions makes it a formidable player in the Channels business. The company’s strategy of keeping churners engaged, boosting ARPU, and securing more favorable revenue-sharing agreements ensures higher margins and a stickier user base.

We expect the Channels model to grow across the streaming industry. We predict that within the next five years, Netflix will launch its own Channels program, allowing users to subscribe to third-party services through its platform. This trend toward aggregation will reshape the streaming landscape further, and Fubo’s early move positions it well for long-term success.