I recently had the chance to catch up with The Streaming Madman—a character mostly loved and sometimes loathed for his outspoken and unapologetically honest takes on the media industry. Our conversation naturally veered towards mergers, a topic he’s never short of opinions on. From the impending DirecTV and Dish merger to the infamous corporate entanglements that have shaped (and sometimes misshaped) HBO over the years, we covered it all. And speaking of HBO, our upcoming From the Archives column will take a deep dive into the complex, merger-driven history of the iconic network’s streaming journey.

One thread that kept resurfacing was a recent piece from Business Insider, which reported on David Zaslav’s rumored pursuit of a merger between Warner Bros. Discovery and Paramount. According to Business Insider, Zaslav spent much of 2024 chasing the deal, only to back off from making a formal cash offer—an essential condition for Paramount’s Shari Redstone. Instead, Paramount is moving forward with a takeover by David Ellison, backed by his father Larry, which is planned for next year. The news highlights the constant financial balancing act in the streaming industry, where consolidation and survival are often intertwined.

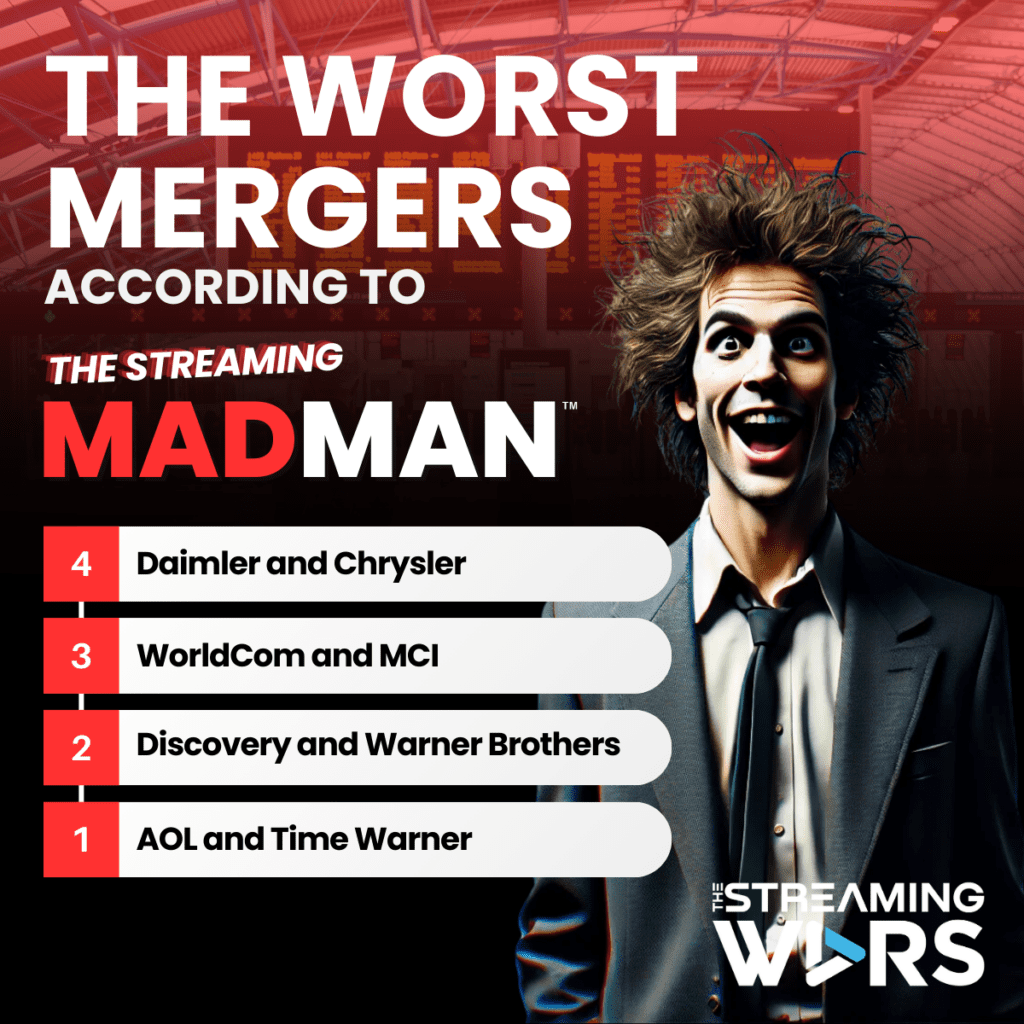

With all this fresh in our minds, I couldn’t resist asking The Streaming Madman about his least favorite mergers of all time. His responses were classic Madman: witty, biting, and deeply insightful. Here are his picks for the worst mergers in history—and why they deserve their spot on the wall of shame.

1. AOL and Time Warner

TSM: They literally had one private jet at Teterboro and one at Dulles, just waiting for someone, anyone, to go back and forth. I knew folks from DC who’d turn Manhattan weekends into a regular thing, all on the company dime. And then there were the New Yorkers who learned to ride horses out in Fairfax and Loudoun County. It was corporate absurdity at its finest.

This merger was supposed to be the ultimate marriage of old and new media, bringing together the internet giant AOL with the storied Time Warner. Instead, it became a corporate nightmare—a mismatch of cultures, ambitions, and visions that ultimately went up in flames. It’s now remembered as one of the biggest flops in business history.

2. Discovery and Warner Brothers

TSM: “Again with the Warners. A conflagration of debt service all to satisfy the ever-expanding ego of just one CEO. The ghost of Jack Warner will haunt this malformed beast of a company until it burns like the House of Usher.”

Discovery’s acquisition of Warner Brothers hasn’t exactly gone smoothly. Encumbered by staggering debt and a struggle to integrate two very different corporate cultures, the merger reflects a familiar tale of ambition turned liability. The Madman sees this as yet another “Frankenstein merger” doomed from within.

3. WorldCom and MCI

“This one’s where the Enron guys got all their grand ideas. Little Mississippi (spelled that myself while mouthing the letters) company somehow gets its hands into some deep pockets and acquires an actual company that mattered. Absolute corporate carnage.”

The WorldCom-MCI merger is infamous not just for its collapse but for its role in one of the largest corporate fraud scandals ever. With CEO Bernie Ebbers at the helm, WorldCom manipulated its financials to keep up appearances, ultimately leading to bankruptcy and criminal charges. It remains a cautionary tale in corporate governance.

4. Daimler and Chrysler

“If you could write a corporate rom-com about two unlikely characters in an arranged marriage, this would be it. The folks in Auburn, Michigan never knew what hit them, and the folks in Stuttgart made away with some interesting stories. The only output of this union worth even remembering was a rushed to market coupe called “Crossfire”, the SRT version of which TSM loved enough to get several speeding tickets from some very irate state troopers.”

The Daimler-Chrysler merger was a cultural and operational mismatch from the start. The German automaker and the American icon couldn’t see eye to eye on much, and the split was inevitable. Chrysler, especially, suffered from the breakup, losing out in a deal that promised synergies but delivered little more than corporate friction.